Institutional Trading Traps: How to Recognize and Avoid Costly Mistakes

Discover common traps set by institutions in the market, understand why they occur, and learn strategies to avoid these costly mistakes in your trading.

“Trading is simple, but not easy. The greatest barrier to success is psychological.” – Mark Douglas

Ever felt like the market was watching you? You spot a textbook breakout, hit buy, and then bam! the price slams back against you. You’re not alone. This frustrating pattern isn’t bad luck. It’s often the result of institutional traps set to exploit predictable retail behavior.

Institutions have deeper pockets, faster execution, and access to data retail traders rarely see like Level 2 order flow and liquidity zones. They use this edge to manipulate price, triggering stop hunts, fakeouts, and false breakouts. If you’re unaware of how these traps work, you’ll keep feeding liquidity to the other side of the trade.

If you're ready to stop being the bait and start trading smarter, keep reading.

Key Takeaways:

- Institutions often use fake breakouts, liquidity grabs, and engineered volatility to trap retail traders.

- Recognizing price behavior around key levels is more effective than relying solely on indicators.

- True breakouts typically follow liquidity sweeps or false moves in the opposite direction.

- Most retail platforms don’t offer full visibility into Level 2 order flow, putting traders at a disadvantage.

- Developing patience and waiting for confirmation after manipulative price moves is critical.

Understanding Institutional Trading Traps

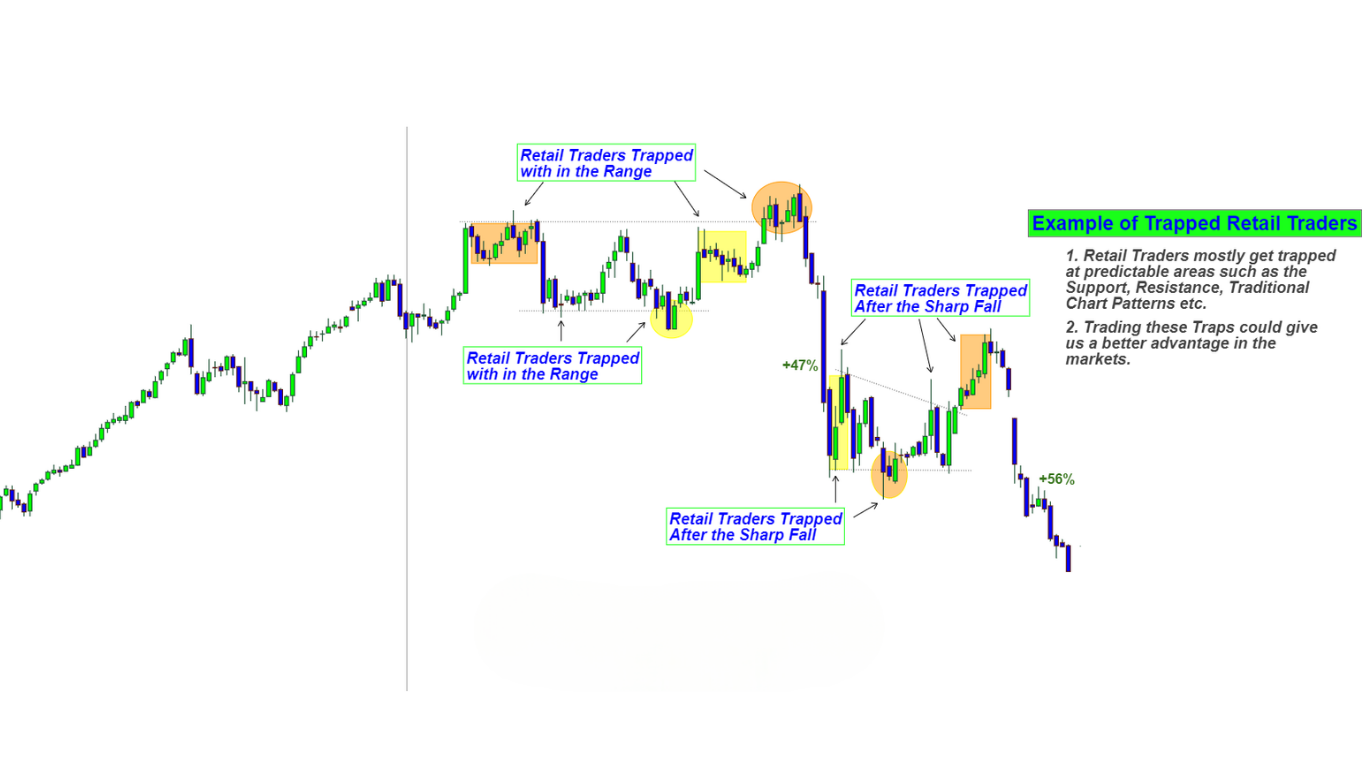

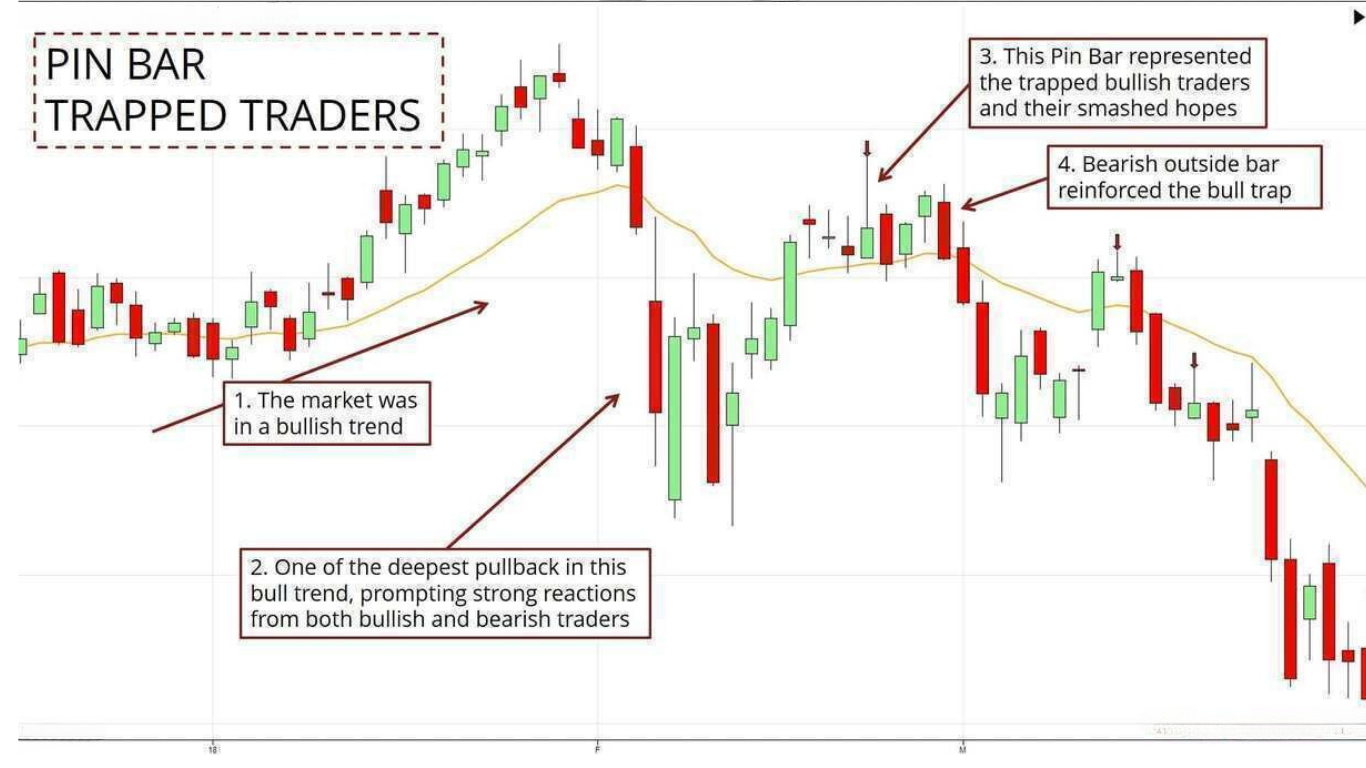

Institutional trading traps are deliberate price moves designed to lure retail traders into poor positions just before the market reverses. These traps are engineered to exploit common retail behaviors like breakout chasing, FOMO, and tight stop-loss placement. Understanding these traps is the first step to avoiding them.

Why Institutions Set Traps

Institutions set traps because they need liquidity and retail traders provide it. Unlike small traders, big players can’t just hit buy or sell without moving the market. So they create price moves that lure retail traders into mistakes.

1. To Fill Large Orders

Big orders require volume. By triggering breakouts or stop runs, institutions attract a flood of retail trades. This gives them the liquidity they need to enter or exit positions without slippage.

2. To Exploit Emotions

Retail traders often react emotionally by buying breakouts, panicking on stop-outs, or chasing trends. Institutions set traps to capitalize on this behavior, entering trades just as retail gets in (or out) at the worst possible time.

3. To Accumulate or Distribute Stealthily

Traps help institutions build (accumulate) or offload (distribute) positions gradually. They use false moves to mislead retail traders and mask their real intentions until they’re ready to commit to the trend.

Common Institutional Trading Traps

- Liquidity Sweeps: Sudden moves above or below key highs/lows to trigger stop losses.

- Fake Breakouts: Price breaks a structure level only to reverse quickly after attracting entries.

- False Momentum: Volume and volatility spike misleadingly to lure traders in before a reversal.

- Induced Entries: Clean price action patterns used to bait retail participation, then quickly reversed.

- Midday Reversals: Institutional algorithms often reverse price around the NY lunch session, when retail volume is low.

Retail vs. Institutional Behavior Table

| Scenario | Typical Retail Behavior | Institutional Behavior (Smart Money) |

|---|---|---|

| Breakout above resistance | Buys breakout immediately | Sells into breakout (liquidity grab) |

| RSI is overbought | Sells based on indicator alone | Waits for structure + liquidity sweep |

| Price hits new high | Enters long late | Sets up reversal trade after drawing buyers |

| News release volatility | Chases the first move | Fades the overreaction or waits for liquidity |

| Clean trendline break | Short on trendline break | Stops out retail then reverses price |

| Consolidation range | Waits for clear breakout | Triggers stop hunts above/below range first |

How to Identify Institutional Trading Traps

Price Action

- Sudden and unsustained spikes above or below significant levels.

- Immediate price reversal after breaking support or resistance.

Volume Analysis

- Abnormal volume spikes coinciding with brief price movements.

- Low-volume breakouts indicating a lack of genuine buying or selling pressure.

Candlestick Patterns

- Reversal patterns immediately following false breakouts.

- Long wicks indicating rejection at key price levels.

Strategies to Avoid Institutional Traps

1. Wait for Confirmation

Always wait for the candle to close beyond critical levels to confirm a genuine breakout or breakdown.

2. Utilize Higher Timeframes

Higher timeframe analysis helps filter out short-term traps and provides better perspective on true market direction.

3. Volume Confirmation

Ensure breakouts or breakdowns are supported by significant and sustained volume.

4. Set Intelligent Stops

Place stops beyond clear trap zones instead of obvious, frequently targeted areas.

Practical Example of Avoiding a Trap

Consider stock XYZ nearing resistance at $100. Price quickly breaks $100, triggering retail buy orders. However, volume remains low, and the price immediately falls back below $100. Traders waiting for high-volume confirmation and candle closes above $100 avoid this trap.

Combining Other Tools to Avoid Traps

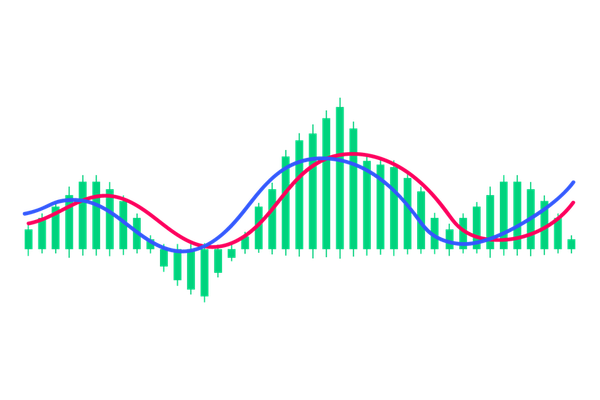

- Moving Averages: Confirm trend direction and strength.

- VWAP: Provides institutional price levels and average transaction prices.

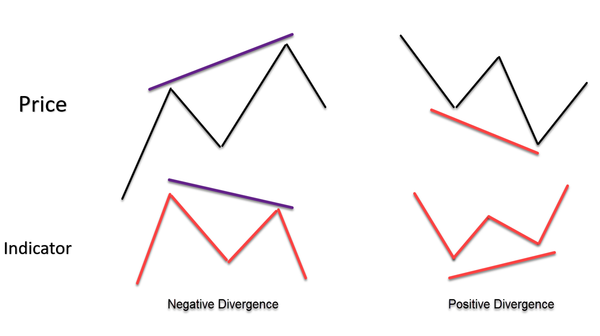

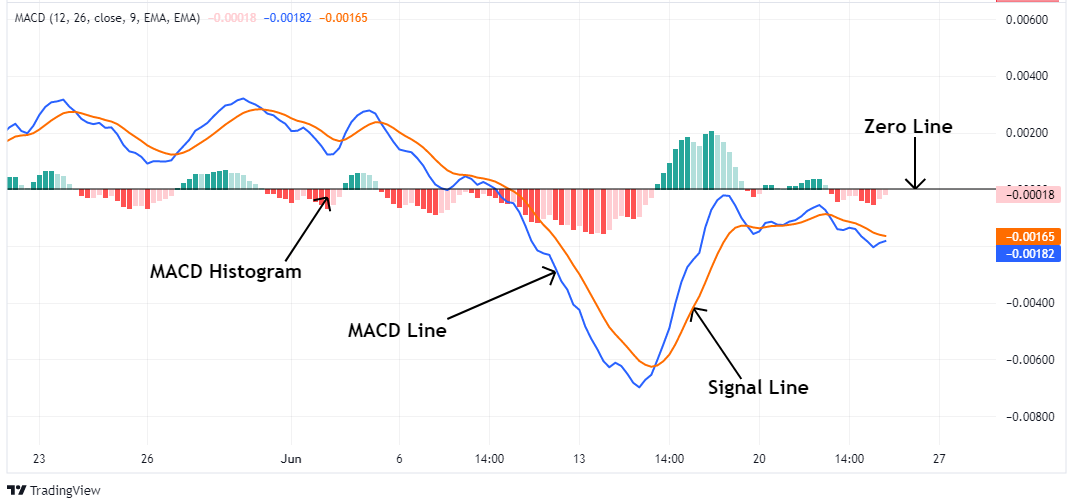

- RSI and MACD: Signal divergences and shifts in momentum, indicating potential traps.

Recommended Internal Resources

Retail Traders & Level 2 Data

Most retail trading platforms do not provide full Level 2 order book data, which limits your ability to see where institutional interest truly lies. Even when Level 2 is available, it may show a fraction of the actual market depth due to hidden orders (iceberg orders), delayed feeds, or limited market access. This puts retail traders at a major disadvantage when trying to assess true supply and demand zones.

Instead of relying solely on this data, retail traders should focus on price action around key liquidity areas—such as previous highs/lows, consolidation zones, or psychological levels to infer institutional behavior. Watching how price reacts to these zones gives more edge than reacting to misleading volume spikes or shallow order books.

Final Thoughts

Institutional traps are an ever-present market reality. Recognizing and avoiding these common pitfalls is essential for trading success. By combining price action analysis, volume confirmation, higher timeframe insights, and disciplined risk management, you can effectively sidestep institutional traps and enhance your trading outcomes.

Commit to ongoing learning and disciplined trading, and confidently navigate markets dominated by institutional players.

FAQs

Q1: What’s the best way to avoid institutional traps?

A: Wait for price to return back inside the range after a breakout or sweep, and only trade once structure confirms direction. Avoid impulsive entries at extremes.

Q2: Can retail traders detect smart money moves without order flow tools?

A: Yes. Watching how price reacts to support/resistance, using time-based sessions (like London/NY), and analyzing wicks and rejection candles can reveal institutional intent.

Q3: Are trading indicators useless against institutional traps?

A: Not useless—but they’re reactive. Indicators lag price. Combining them with structure and context helps avoid trap zones.

Q4: Is Level 2 data available for forex?

A: Not truly. Forex is decentralized, so there's no central order book. Some brokers simulate Level 2, but it’s limited and doesn’t reflect the true institutional flow.

Q5: Do institutions trap each other too?

A: Yes. Institutions often compete against each other for liquidity. However, they have better data, execution speed, and market impact control than retail traders.