VWAP Trading Strategy: Your Guide to Smarter Trading Decisions

Discover the power of VWAP for intraday trading. This guide covers how to effectively use VWAP to improve entry and exit decisions, manage risk, and increase profitability.

“The goal of a successful trader is to make the best trades. Money is secondary.” — Alexander Elder

The Volume Weighted Average Price (VWAP) is a powerful technical indicator used by professional traders and institutions to measure the true average price at which a security trades throughout the day. This guide provides comprehensive insights into effectively utilizing the VWAP trading strategy, enabling you to make informed decisions and improve your trading performance significantly.

What is VWAP?

VWAP calculates the average price of a security traded over a certain period, weighted by trading volume. It gives traders insight into market trends and helps determine market bias by comparing current price levels to the average price traded.

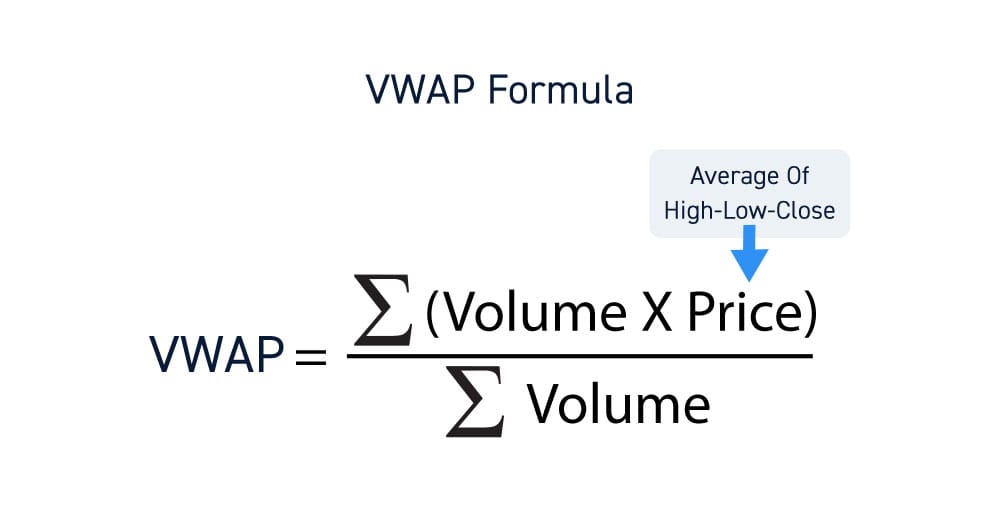

VWAP Calculation

The VWAP is calculated as follows:

Why Traders Use VWAP

- Institutional Benchmark: Institutions often use VWAP as a benchmark for order execution, ensuring trades align closely with the market average.

- Trend Identification: VWAP helps traders identify whether buyers or sellers are controlling the market.

- Support and Resistance: VWAP often acts as dynamic support and resistance, influencing price movements.

How to Use VWAP for Trading Decisions

Identifying Market Bias

- Bullish Bias: Price above VWAP indicates buyer strength.

- Bearish Bias: Price below VWAP indicates seller dominance.

Entry and Exit Points

- VWAP Pullbacks: Enter trades when prices retrace back to VWAP during an uptrend or downtrend.

- VWAP Breakouts: Trade breakouts when prices move through VWAP with strong volume, confirming new market direction.

Risk Management

Use VWAP to define logical stop-loss and profit targets. Set stops below VWAP for long positions and above VWAP for short positions.

VWAP Trading Strategies

Strategy 1: VWAP Pullback

Entry Criteria:

- Price clearly above VWAP, indicating bullish bias.

- Wait for price pullback to VWAP.

- Enter when a bullish reversal candlestick forms at or near VWAP.

Exit Strategy:

- Stop-loss placed below recent support or slightly below VWAP.

- Take-profit targets set at previous highs or significant resistance levels.

Strategy 2: VWAP Breakout

Entry Criteria:

- Price crosses above or below VWAP with increasing volume.

- Confirm the move with candlestick patterns and additional indicators like RSI or moving averages.

Exit Strategy:

- Place stop-loss slightly below (for longs) or above (for shorts) the VWAP line.

- Set realistic take-profit targets based on recent price action.

Combining VWAP with Other Indicators

VWAP and RSI

Using VWAP with RSI helps confirm overbought or oversold conditions, enhancing trade accuracy.

VWAP and Moving Averages

Combining VWAP with EMA/SMA crossovers provides a more robust indication of market trends and trade signals.

Common Mistakes Traders Make with VWAP

- Ignoring Volume: Trading based on VWAP without considering volume can lead to false signals.

- Overtrading Around VWAP: Trading every minor VWAP interaction can lead to overtrading and increased risk.

- Misplaced Stops: Setting stops too close or far from VWAP can result in unnecessary losses or missed opportunities.

Advanced VWAP Techniques

Anchored VWAP

Anchored VWAP starts calculations from significant events or dates, providing deeper insight into price levels important to market participants.

VWAP Bands

VWAP bands plot standard deviation lines around the VWAP, highlighting areas of potential support, resistance, and volatility.

Practical Example of VWAP Trading

Consider this practical example:

- Market Scenario: Stock XYZ trading above VWAP

- Trade Entry: Price retraces to VWAP with reduced volume, forming a bullish engulfing candle.

- Trade Execution: Enter at bullish candle confirmation

- Stop Loss: Set slightly below VWAP

- Profit Target: Recent resistance levels or previous highs

This trade demonstrates effective use of VWAP for risk-managed entries and clear exit strategies.

Recommended VWAP Trading Tools

- TradingView: Offers VWAP indicator and customizable settings

- Thinkorswim: Powerful platform featuring advanced VWAP analysis tools

- Broker Platforms: Many broker-provided platforms include built-in VWAP indicators