Understanding Risk-Reward Ratio: The Key to Consistent Trading Profits

A strong risk-reward ratio is the foundation of successful trading. Mastering this concept helps you grow your account, reduce losses, and trade with confidence.

“Successful people ask better questions, and as a result, they get better answers.” — Tony Robbins

The difference between profitable traders and those who burn out is rarely about picking the right stock. It’s about managing risk. That’s why understanding and consistently applying the risk-reward ratio is absolutely essential if you want to succeed long-term.

In this post, we’ll break down what the risk-reward ratio is, how to use it, and how it can transform your results—whether you’re a beginner or a seasoned trader.

Key Takeaways

- A good Risk-Reward Ratio (R:R) helps traders stay profitable even with a lower win rate.

- R:R is not fixed; it should adapt to the trade setup and strategy.

- Understanding expectancy helps connect R:R with actual results.

- Most new traders overestimate win rate and underestimate the impact of losses.

- Smart risk management starts with defining R:R before entering a trade.

What Is Risk-Reward Ratio?

The risk-reward ratio measures how much you're willing to risk in comparison to how much you expect to gain. It’s a simple formula:

Risk-Reward Ratio = Potential Loss / Potential Gain

For example, if you risk $100 to make $300, your ratio is 1:3. This means that even if you're right only 30% of the time, you could still come out profitable.

Why Risk-Reward Matters So Much

Without a clearly defined risk-reward strategy, your trading is no better than gambling. Here’s what the ratio helps with:

- Controls Emotions: Knowing your risk up front reduces emotional trading.

- Improves Discipline: You stop chasing bad trades or revenge-trading losses.

- Boosts Profitability: With a 3:1 ratio, you can afford to lose twice as often as you win and still grow your account.

Ideal Risk-Reward Ratios

Here are a few commonly used ratios and how they affect your trading:

| Ratio | Meaning | Needed Win Rate |

|---|---|---|

| 1:1 | Risk $100 to make $100 | >50% |

| 1:2 | Risk $100 to make $200 | 33% |

| 1:3 | Risk $100 to make $300 | 25% |

The 1:2 and 1:3 ratios are commonly recommended for swing traders and intraday traders. The key is to stay consistent.

How to Use Risk-Reward in Your Trading

1. Define Entry, Stop, and Target Before Entry

You should always know where you’re entering, where you’ll exit if wrong (stop loss), and where you plan to take profit.

2. Use Support/Resistance to Frame Trades

Don’t randomly set targets—use previous highs/lows or Fibonacci levels for realistic price moves.

3. Journal Every Trade

Tracking your trades in a journal helps you understand if you’re sticking to your ratios. Tools like Notion or Google Sheets can simplify this.

Risk-Reward Strategy Examples

Example 1: Long Trade

- Entry: $100

- Stop Loss: $95

- Take Profit: $115

Here, you risk $5 to make $15. That’s a 1:3 ratio.

Example 2: Short Trade

- Entry: $150

- Stop Loss: $155

- Take Profit: $135

You’re risking $5 to make $15 again. Another solid 1:3 trade.

| Win Rate | Risk:Reward | Expectancy Outcome |

|---|---|---|

| 50% | 1:1 | Breakeven |

| 40% | 1:2 | Positive (profitable) |

| 30% | 1:3 | Positive |

| 60% | 1:0.5 | Negative (unprofitable) |

Combining With Other Tools

Risk-reward becomes even more powerful when combined with:

- Volume Profile: Avoid high-volume zones when setting stops.

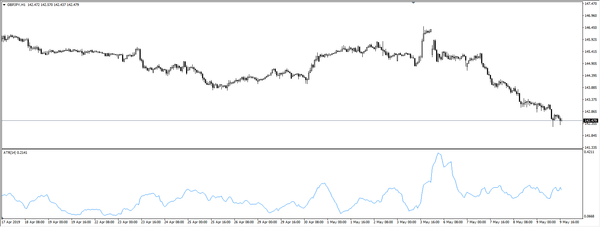

- RSI or MACD: Avoid fighting strong trends, even if the ratio looks good.

- Moving Averages: Use the 20 or 200 EMA to align with market momentum.

Common Misconceptions About Risk-Reward

- “High R:R is Always Better”

A 5:1 R:R sounds great, but if the setup is rare or has only a 10% win rate, you may never reach consistent profitability. Balance matters more than extremes. - “You Can Always Control the Reward”

Traders often assume reward is guaranteed. In reality, price may not reach your full TP, and trade management matters. - “1:1 R:R is Useless”

Not true. If you have a high win rate (like 70%+), even a 1:1 R:R can be highly profitable. It’s about the full system, not one number. - “Risk-Reward = Profit”

It doesn’t. R:R only sets a potential outcome. Actual profit depends on win rate, psychology, slippage, and trade execution.

How Expectancy Ties It All Together

Expectancy shows the average amount you expect to make per trade. It combines your win rate with your R:R in a powerful formula:

Expectancy = (Win% × Avg Win) – (Loss% × Avg Loss)

Example:

If you win 40% of trades with a 1:2 R:R, and lose 60% of trades risking $100:

- (0.4 × $200) – (0.6 × $100) = $80 – $60 = $20 expectancy

That means on average, you’re making $20 per trade. This simple calculation can reveal whether your system is worth scaling or needs tweaking.

Mistakes Traders Make With Risk-Reward

- Ignoring Market Volatility: Your stop might be too tight in a volatile market, leading to early exits.

- Forcing Trades: Don’t enter a trade just because it offers a good ratio. It must meet your setup criteria.

- Not Adjusting for Position Size: A 1:3 ratio won’t help if your position size is too big or too small. Proper position sizing is crucial.

Building a Risk-Reward System

Set rules like:

- Never take trades with less than 1:2 ratio

- Use alerts for price levels that give ideal ratios

- Exit early if trade invalidates setup (don’t just hope)

Final Thoughts

Mastering your risk-reward ratio will completely change your trading mindset. You’ll stop asking “Is this stock going up?” and start asking “Is this trade worth the risk?”

Over time, this discipline compounds into consistency—and consistency is the name of the game.

FAQs

Q1: What is the best R:R ratio for beginners?

A1: A simple 1:2 ratio is a great starting point. It encourages better entries and discipline without needing a high win rate.

Q2: Can I still win if my R:R is less than 1:1?

A2: Yes, but only if your win rate is very high (70%+). It’s harder to sustain psychologically, though.

Q3: How do I find my actual R:R?

A3: Use a journal or platform like MyFxBook or Edgewonk to track your trades and calculate average risk and reward.

Q4: What’s a good expectancy?

A4: Any positive expectancy means your strategy is profitable. Aim for at least $0.10–$0.20 per $1 risked over time.

🔗 External Resources:

- Investopedia: What is Risk/Reward Ratio

https://www.investopedia.com/terms/r/riskrewardratio.asp - Investopedia: Risk Management in Trading

https://www.investopedia.com/terms/r/riskmanagement.asp