The Truth About MACD Settings: Default or Custom?

Should you use MACD’s default settings or try your own? In this beginner-friendly post, we explain what each MACD setting does, how custom settings change your signals, and how to choose the right setup for your strategy.

“In trading, there is no holy grail. Success lies in finding what works for you—and that means adapting your tools.”

— John Murphy

Most traders use the MACD just as it comes with the default settings and all. But is that always the best choice? In this guide, we’ll explore what those settings mean, whether you should change them, and how to make MACD work better for your trading style.

Key Takeaways

- The default MACD settings are 12, 26, and 9, and they work well for many people.

- Custom MACD settings can help short-term or long-term traders see better signals.

- There’s no “one-size-fits-all” test and choose what works best for you.

- Fast settings give quicker signals but more noise. Slow settings are cleaner but slower.

- Always match your MACD settings with your trading time frame.

What Are the Default MACD Settings?

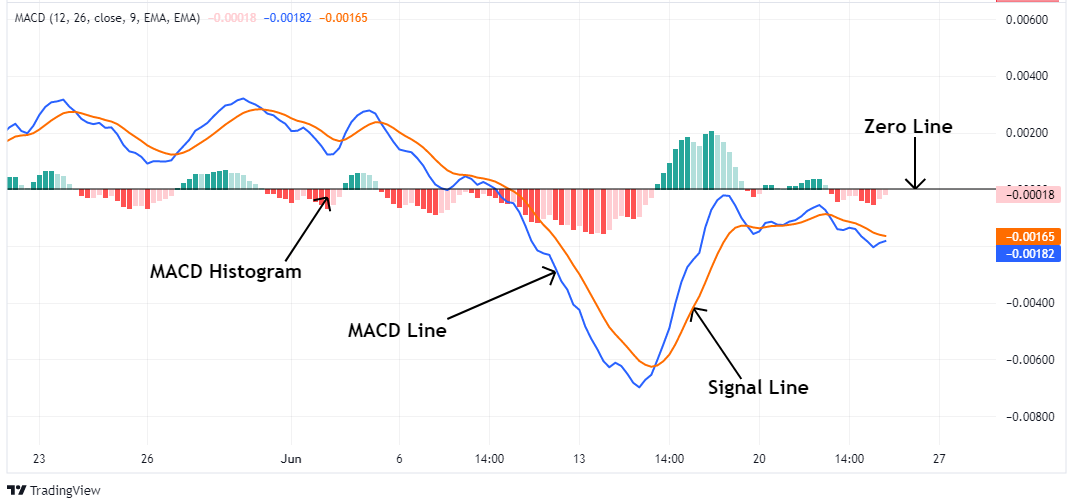

The MACD has three numbers: 12, 26, and 9. These are called the parameters.

- 12 = the fast EMA (Exponential Moving Average)

- 26 = the slow EMA

- 9 = the signal line EMA

These settings are the same for most charting platforms like TradingView, MT5, and others. They were made for daily charts, so they work well if you’re trading over a few days to weeks.

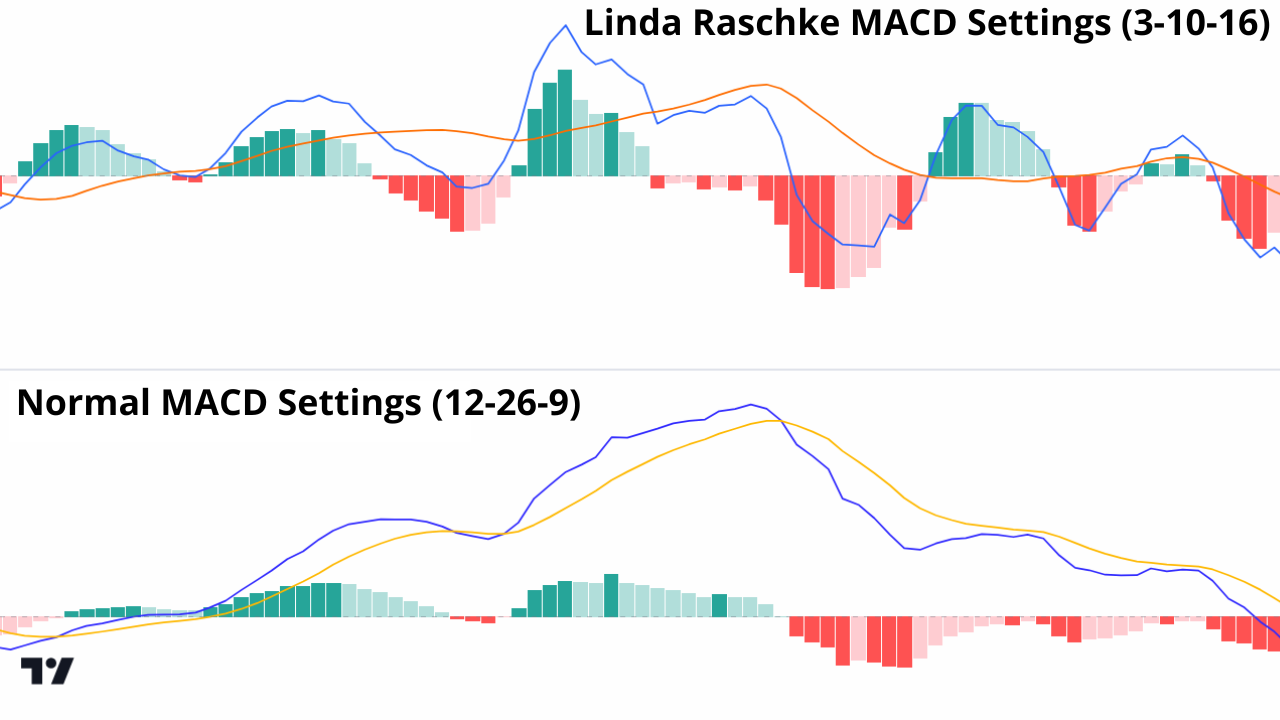

What Happens When You Change MACD Settings?

Changing the numbers changes how MACD behaves. For example:

- If you lower the numbers (like 6, 13, 5), MACD moves faster. You’ll get more signals, but they might be fake or too early.

- If you raise the numbers (like 24, 52, 18), MACD moves slower. You’ll get fewer signals, but they’ll be stronger and more reliable.

So ask yourself: do you want more signals faster or fewer signals with more power?

Best MACD Settings by Trading Style

Let’s look at how MACD settings fit different types of traders.

|

Trading Style |

Example Time Frame |

Suggested MACD Settings |

What It Does |

|

Scalping |

1-min to 5-min |

6, 13, 5 |

Fast signals, high noise |

|

Day Trading |

5-min to 30-min |

8, 21, 5 |

Balanced speed and accuracy |

|

Swing Trading |

1H to Daily |

12, 26, 9 (Default) |

Steady signals for trends |

|

Position Trading |

Daily to Weekly |

24, 52, 18 |

Slow signals, stronger trends |

If you’re new, start with the default. As you get better, try tweaking the settings based on how you trade.

How to Choose the Right Settings for You

Picking the best MACD settings isn’t just about copying what others use. It’s about understanding how you trade, what your goals are, and how much time you spend in the market. Let’s break it down so you can find the right fit.

Understand Your Trading Style

Your MACD settings should match your trading personality. Ask yourself:

- Do I like quick trades, or do I prefer holding longer?

- How often do I check my charts?

- Do I want fast signals or strong, clear ones?

If you’re a scalper or fast-paced day trader, faster MACD settings (like 6, 13, 5) can give more frequent entry signals. But they’ll also catch more market “noise” and give more false alarms.

If you’re a swing trader or position trader who holds trades for days or weeks, the default 12, 26, 9 or even slower like 24, 52, 18 can help you catch bigger trends with more reliable signals.

Match Settings to Your Time Frame

MACD should fit your chart. Short time frames need faster signals. Longer time frames benefit from slower, smoother MACD behavior.

- 1–5 minute charts: Use 6, 13, 5 for speed.

- 15-minute to 1-hour charts: Try 8, 21, 5 or stick to the default.

- Daily charts and above: Use the standard 12, 26, 9 or go slower if you want fewer but cleaner signals.

Think of MACD as a lens. A wide-angle lens (slow settings) gives you a broad view. A zoom lens (fast settings) lets you see tiny movements but you may miss the bigger picture.

Consider Market Conditions

Not all markets move the same. During high-volatility periods (like after big news events), fast settings may go crazy with false signals. Slower settings help filter out the noise. In low-volatility periods, faster settings might be helpful because they show the small changes that slow settings might miss.

Test Before You Trade Real Money

One of the best ways to find the right MACD setting is to backtest. Use a demo account and try different settings on historical charts. Ask:

- How many good signals do I get?

- How often are they false?

- Would I have entered or exited too late?

Also, write it down in a trading journal. Keeping track of what works helps you build a system that fits you, not just the crowd.

Should You Use Default or Custom MACD Settings?

There’s no perfect answer. The default (12, 26, 9) is popular for a reason, it works well for most situations.

But if you feel like you’re always late, or you’re getting too many signals, try changing it. The best way to find out what works is to test.

Use a demo account and compare how different settings perform. Keep a journal. Look at the charts. Then stick with the one that gives you the clearest picture.

Conclusion

MACD is a great tool but how well it works depends on how you set it up. Default settings are a solid start, but don’t be afraid to try custom ones. Whether you trade fast or slow, there’s a MACD setup that fits your style. The key is to keep it simple, test your changes, and use the setting that gives you the most confidence.

FAQs

1. What are the default MACD settings?

The default MACD settings are 12 (fast EMA), 26 (slow EMA), and 9 (signal line).

2. Can I use different MACD settings on different time frames?

Yes! Faster settings work better on short time frames. Slower settings are better for long-term charts.

3. Do custom settings make MACD more accurate?

They can! Custom settings help you fine-tune MACD to your own trading style, but they also come with trade-offs.

4. Is the default MACD setting good for beginners?

Absolutely. Start with 12, 26, 9 while you learn, then experiment once you’re more comfortable.

5. How can I test if custom settings work?

Use a demo account. Try different settings. Take notes. See which one gives you the clearest signals and best results.