The Psychology of Trading: Mastering the Mental Game for Long-Term Success

The markets don’t just test your strategy — they test your mind. Discover how mastering trading psychology can elevate your results and build lasting success.

“It’s not the market you have to beat, it’s yourself.” — Mark Douglas

You can have the perfect strategy. The best indicators. Top-tier trade setups.

But if your mind isn’t right — you’ll lose.

That’s why trading psychology is often said to account for 80% of success in the markets. Strategies are replicable. Tools are available to everyone. But emotional control? That’s internal. And it’s what separates amateurs from elite traders.

In this post, we’ll break down the psychological traps, how to build discipline, and create a mental edge that lasts.

Why Trading Psychology Is Everything

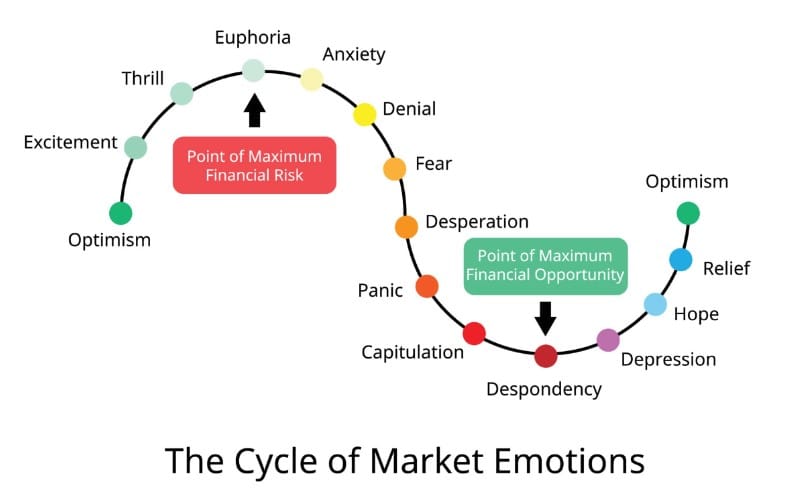

The market is a mirror. It reflects not only price action but your own fears, biases, and emotions. New traders often get caught in psychological loops such as:

- Fear of Missing Out (FOMO)

- Revenge Trading After a Loss

- Overtrading Due to Boredom

- Closing Profitable Trades Too Early

- Ignoring Stops in Hopes of a Reversal

These decisions don’t come from strategy — they come from emotion.

To fix your results, you first have to fix your reactions.

Understanding the Core Emotions

Let’s take a closer look at the three core emotions traders battle most:

1. Fear

Fear causes hesitation. It makes you doubt your setup, cut winners short, or avoid taking trades. Often rooted in past losses, fear can paralyze your progress.

Solution: Trade smaller position sizes until your confidence builds. Stick to your plan and celebrate following it, not just the outcome.

2. Greed

Greed tempts you to overleverage, chase parabolic stocks, or hold past your profit target. It clouds logic and leads to blow-ups.

Solution: Set a fixed take-profit and stick to it. Journaling can help you recognize patterns where greed led to bad outcomes.

3. Impatience

Impatience shows up as overtrading or entering without confirmation. It’s the urge to always “be in something.”

Solution: Focus on quality over quantity. Create strict criteria for entries and wait for the market to come to you.

Create a Psychological Edge

You won’t eliminate emotions — but you can manage them with structure and repetition. Here's how:

1. Have a Trading Plan

Your plan should include:

- Entry and exit criteria

- Risk-reward targets

- Max daily loss limits

- Specific setups you trade

When emotion hits, the plan keeps you anchored.

2. Use Affirmations and Mental Prep

Start your day with affirmations like:

- “I follow my plan without hesitation.”

- “Each trade is just one of many.”

- “My edge plays out over time.”

You’re not just trading stocks — you’re reprogramming your mindset.

3. Develop a Post-Trade Routine

After each session, journal:

- What went well

- What you could improve

- How you felt before, during, and after trades

This builds self-awareness, which leads to better decisions.

Tools to Improve Trading Psychology

- Meditation Apps: Headspace or Calm can train mindfulness and improve patience

- Books:

- Trading in the Zone by Mark Douglas

- The Disciplined Trader by Mark Douglas

- The Psychology of Money by Morgan Housel

- Visualization: Picture your perfect execution each morning

- Community: Join groups or masterminds that reinforce positive trading habits

Common Trading Psychology Mistakes

- Mistaking Luck for Skill

A green streak doesn’t mean you’ve “figured it out.” Stay humble. - Chasing Losses

Trying to “make it back” in one trade destroys accounts. Cut the urge. - Thinking You’re Owed a Win

The market doesn’t care how many red days you’ve had. Each trade is independent.

Build Discipline Like a Pro

Discipline is built through reps, not motivation. Follow these habits:

- Trade a fixed time block (e.g., 9:30–11:30) and walk away

- Close your broker window after placing a trade to avoid micromanaging

- Set a loss limit (e.g., 2R or 3 red trades) and stop for the day

- Track your mistakes — they become your best teacher

Final Thoughts: Master the Inner Game

Your edge is not just a strategy — it’s your mindset.

You’ll always have losses. You’ll always have emotions. But when you train your brain to respond with discipline, patience, and clarity, you shift from reactive to professional.

Build your trading business from the inside out. Your results will follow.

🔗 External Resources:

- Investopedia: Trading Psychology

https://www.investopedia.com/terms/t/trading-psychology.asp - Investopedia: Behavioral Finance

https://www.investopedia.com/terms/b/behavioralfinance.asp