Smart Money Concepts: Trading Like Institutional Investors

Smart money concepts allow retail traders to align their trades with institutional traders. Learn these strategies to significantly improve your trading accuracy and profitability.

Follow the footprints of big players to navigate the market safely.” – Anonymous

The term “smart money” refers to institutional investors, including banks, hedge funds, pension funds, and other large financial entities. These institutions heavily influence market dynamics due to their substantial capital and sophisticated trading strategies. By learning smart money concepts, retail traders can significantly improve their trade accuracy, risk management, and profitability.

Key Takeaways:

- Smart Money Concepts (SMC) are designed to mimic the behavior of big institutions like banks and hedge funds.

- Key elements include liquidity grabs, inducements, order blocks, and market structure shifts.

- Institutional traders often use tactics that create “traps” for retail traders like false breakouts or engineered liquidity runs.

- Combining SMC with order flow or volume data can increase accuracy.

- The goal is to think one step ahead of the crowd and align with how large players accumulate or distribute positions.

Understanding Smart Money

Smart money traders often have better access to resources, information, and tools compared to retail traders. They utilize advanced trading strategies and have the capability to significantly impact market prices. Understanding their actions and intentions helps retail traders anticipate and trade alongside powerful market moves.

Why Follow Smart Money?

- Enhanced Trade Accuracy: Identifying smart money movements provides high-probability trade setups.

- Improved Risk Management: Understanding institutional positioning helps avoid market traps.

- Consistent Profitability: Aligning with institutional traders increases the probability of successful trades.

Key Smart Money Concepts

1. Liquidity Grabs

Institutions frequently drive prices to liquidity-rich zones to trigger retail stop-losses and accumulate positions.

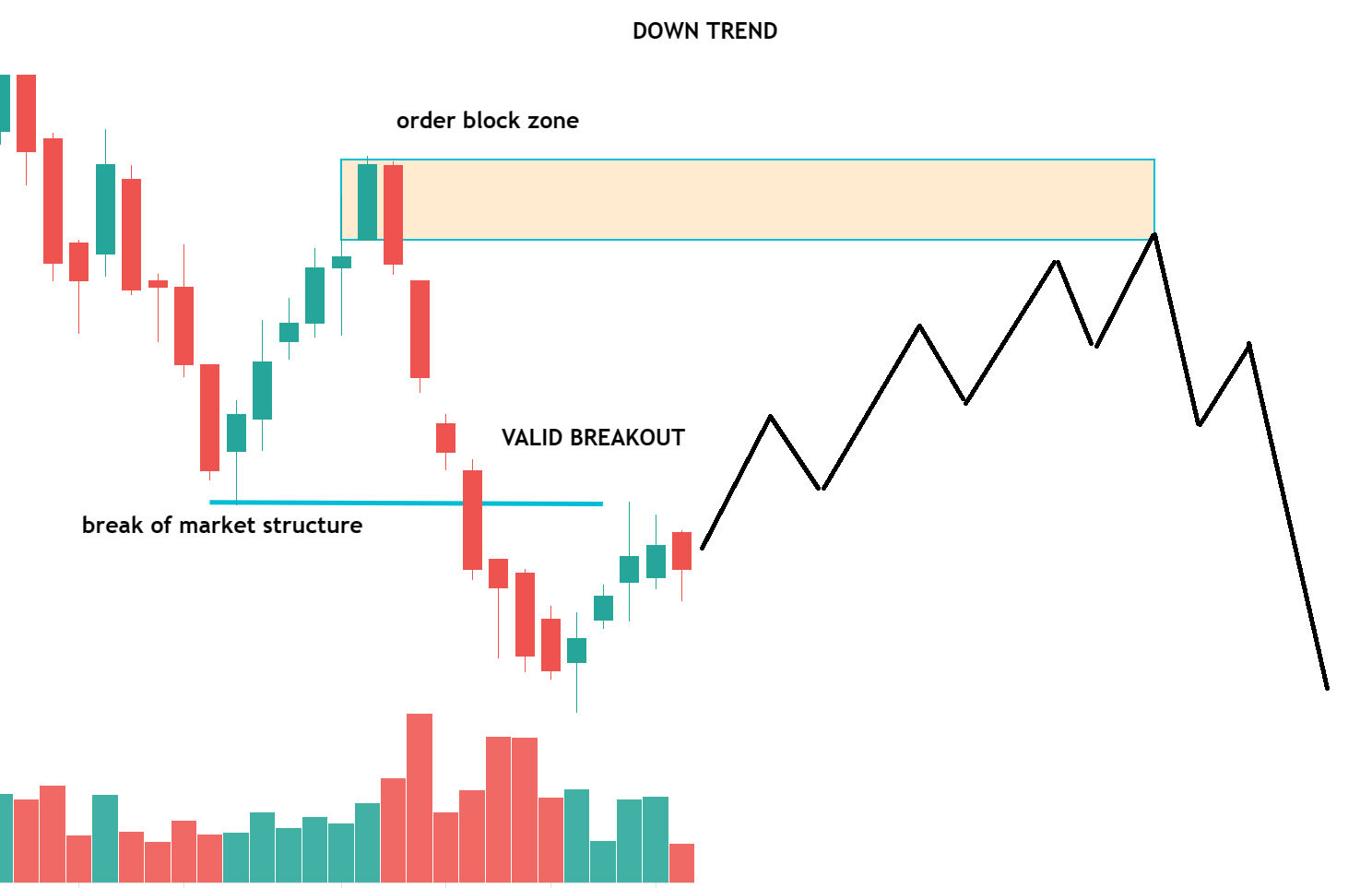

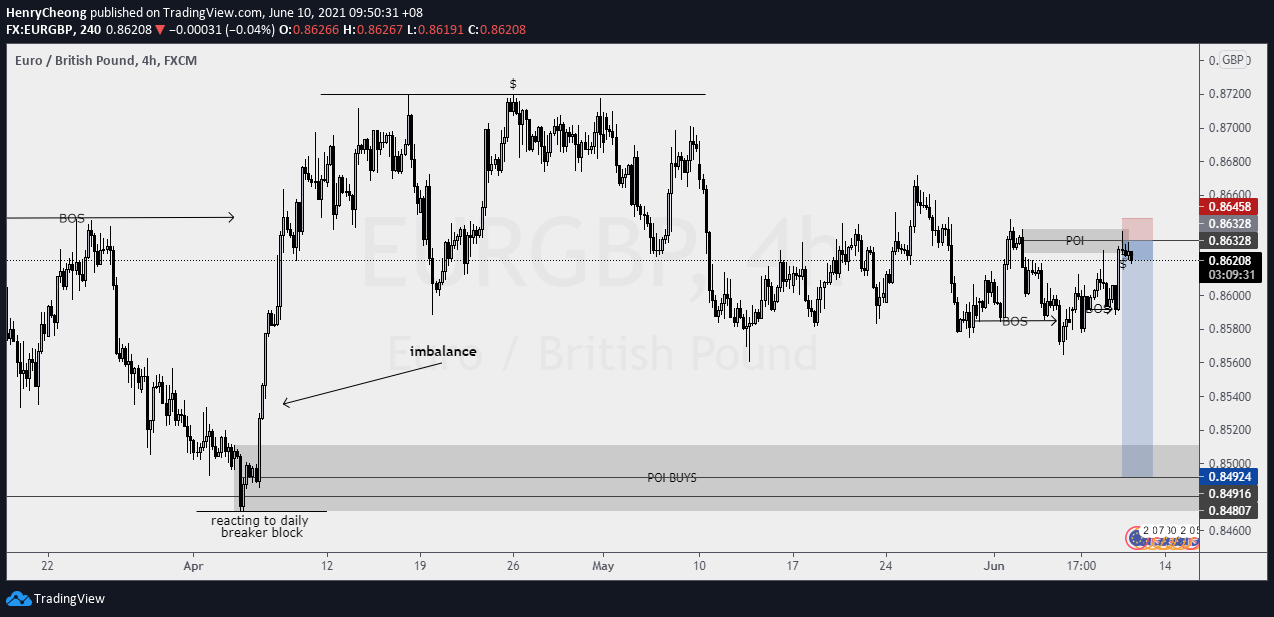

2. Order Blocks

Order blocks represent areas of institutional buying or selling, leading to substantial market moves.

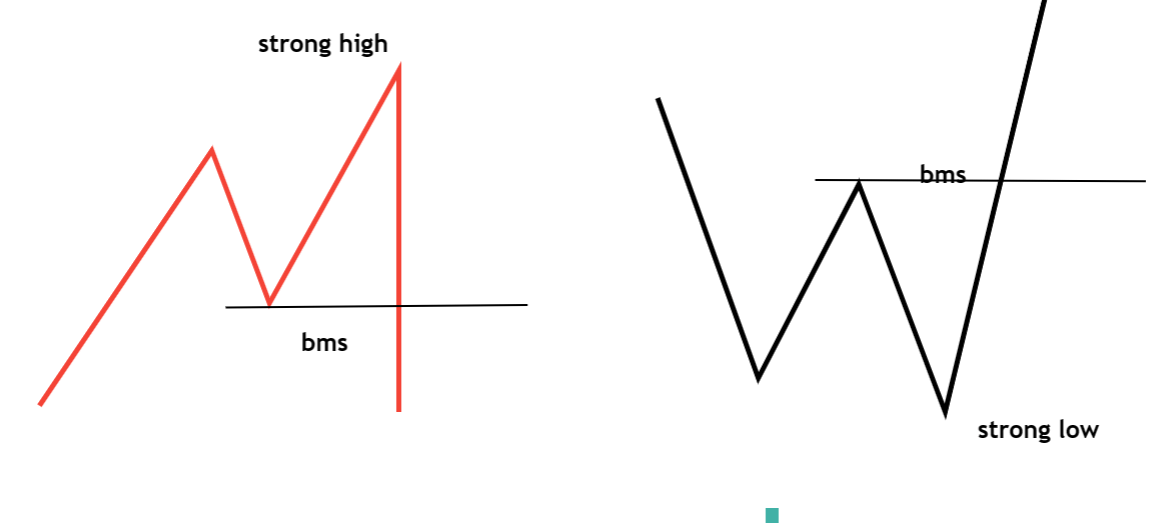

3. Market Structure Breaks

These indicate potential reversals or continuations by highlighting shifts in market trends and momentum.

4. Fair Value Gaps

These price imbalances created by large orders often attract price back for efficient market equilibrium.

How to Identify Smart Money Activity

Price Action

- Look for sharp price moves away from key levels, indicating strong institutional activity.

- Monitor reaction at support and resistance zones.

Volume and Market Depth

- High trading volumes at critical price levels suggest institutional participation.

- Level 2 data can reveal institutional order placement.

Technical Tools

- Footprint charts and Volume Profile show detailed institutional order activity.

Newer Institutional Tactics & Modern Tools

As retail traders become more aware of Smart Money Concepts, institutions have evolved their strategies. Here’s what’s more common today:

1. Layered Liquidity Traps

Institutions now trigger multiple fake-outs. For example, a breakout trap followed by a false retest to sweep more stops and trap both early buyers and late sellers.

2. Iceberg Orders and Hidden Liquidity

Large players may place small visible orders while hiding their real volume (iceberg orders), making retail order flow harder to read unless using depth-of-market tools.

3. News-Aligned Liquidity Sweeps

Institutions often combine scheduled news releases with strategic order placement. Retail traders chasing the news spike get caught, while institutions fill at discounted prices.

4. Tools like Footprint Charts & DOM

Traders who want to go deeper into institutional-style analysis now use order flow tools like footprint charts, Volume Profile, and Depth of Market (DOM) to track real intent.

Trading Strategies Using Smart Money Concepts

Strategy 1: Order Block Trading

Entry: Price retraces to previously identified order blocks.

Exit: Place stop-losses beyond the order block; targets based on logical price structure.

Strategy 2: Liquidity Grab Trading

Entry: Price triggers a liquidity grab and immediately reverses.

Exit: Set conservative stop-losses and aim for recent swing highs or lows.

Strategy 3: Market Structure Breaks

Entry: Enter after confirmed market structure shifts (breaks of key levels).

Exit: Set stops and targets based on established market structure and risk-reward ratios.

Combining SMC with Order Flow or Traps

Instead of just using Smart Money Concepts alone, many traders now combine it with:

- Volume Delta Analysis: Spotting where large buys/sells occur

- Trap Detection: Using candlestick wicks and failed breakouts

- Stop Hunt Zones: Mapping out where stop losses likely lie

- Fair Value Gaps: Identifying imbalance zones where price may return

Combining Smart Money Concepts with Other Strategies

- Moving Averages: Confirm institutional trends.

- VWAP: Track institutional trading prices.

- RSI and MACD: Spot momentum shifts aligning with institutional activity.

Common Pitfalls to Avoid

- Chasing Moves: Wait for clear confirmation before entry.

- Overleveraging: Maintain disciplined position sizing and risk management.

- Ignoring Higher Timeframes: Always analyze market context from higher timeframe charts.

Practical Example

Suppose you identify a bullish order block at $50 on stock XYZ, followed by a market structure break indicating a trend reversal. Price retraces to $50, showing strong bullish candlesticks with increased volume. Enter long, place your stop-loss below the order block, and target previous resistance at $55 for a high-probability trade.

Essential Tools for Smart Money Trading

- Bookmap: Visualizes real-time order flow and institutional trades.

- TradingView: Provides detailed analysis tools, including Volume Profile.

- Footprint Charts: Offer insight into institutional buying and selling pressure.

Recommended Internal Resources

- Order Blocks Explained

- How to Trade with Confluence

- Risk Management Strategies

- Trading Psychology Guide

External Resources

- Investopedia: Smart Money

Final Thoughts

Trading like institutions using smart money concepts empowers retail traders to achieve significantly enhanced trading results. By understanding and anticipating institutional activity, you can trade more confidently, manage risk effectively, and increase your trading profitability.

Stay committed to continuously learning and applying smart money strategies to navigate the markets effectively.

FAQs

Q1: Do Smart Money Concepts still work in 2025?

Yes, but they are evolving. Pairing them with volume, order flow, or trap logic is more effective than using them in isolation.

Q2: What tools can help track smart money?

Platforms like TradingView, Sierra Chart, and Bookmap help visualize market structure, volume spikes, and liquidity zones.

Q3: Are retail traders at a disadvantage?

Only if they trade blindly. With proper tools and understanding, retail traders can follow, not fight, smart money.

Q4: What’s the biggest mistake with SMC?

Overanalyzing and missing clean setups. Simplicity + confluence = edge.

Q5: How do I avoid false signals?

Wait for break-of-structure confirmation. Avoid trading into news unless experienced.