Mastering Risk Management: Protect and Grow Your Trading Capital

Effective risk management separates profitable traders from those who struggle. Discover proven methods to manage trading risk, protect your capital, and achieve consistent growth.

“Risk comes from not knowing what you're doing.” — Warren Buffett

In the world of trading, risk management isn't just a concept—it's your lifeline. Without it, even the best strategies can lead to devastating losses. Successful traders prioritize risk management, knowing that preserving capital is equally important as generating profits. This extensive guide provides practical strategies and insights to help you manage risk effectively, ensuring your trading longevity and profitability.

Key Takeaways

- Never risk more than 1–2% of your trading capital on a single trade.

- Proper risk management prevents emotional, impulsive decisions.

- Position sizing is more important than being right.

- Using tools like risk-of-ruin calculators can give a long-term survival edge.

- Risk management is what turns a good trade into a repeatable system.

What Is Risk Management in Trading?

Risk management involves identifying, analyzing, and mitigating risks associated with trading. It encompasses strategies designed to limit potential losses while maximizing potential gains. Effective risk management allows traders to stay in the game long-term, enabling consistent profitability.

Why Risk Management Is Critical

- Capital Preservation: Protect your trading capital to ensure long-term sustainability.

- Consistent Performance: Managing risk enables stable returns rather than volatile swings.

- Emotional Control: Clearly defined risk parameters reduce emotional decision-making.

- Avoiding Catastrophic Losses: Prevent significant drawdowns that can end your trading career.

Real Case Example: When Risk Management Saved the Day

In 2022, a forex trader based in Singapore traded USD/JPY using a small $5,000 account. After 3 wins in a row, they were tempted to double their position size. But their risk management plan limited each trade to 1%. When the fourth trade went against them, they only lost $50. Had they ignored the rule and gone all-in, it would have been a $600 hit — over 10% of the account. This allowed them to stay in the game, emotionally composed, and they recovered the loss within 3 sessions.

Key Components of Effective Risk Management

1. Position Sizing

Proper position sizing involves determining the amount of capital to risk on each trade. Generally, traders risk no more than 1-2% of their total trading capital per trade to avoid excessive losses.

Example:

- Total Capital: $10,000

- Maximum risk per trade: 2% ($200)

2. Risk/Reward Ratio

Always assess the potential reward versus the risk before entering a trade. A favorable risk/reward ratio (at least 1:2 or greater) ensures your potential reward significantly outweighs your potential loss.

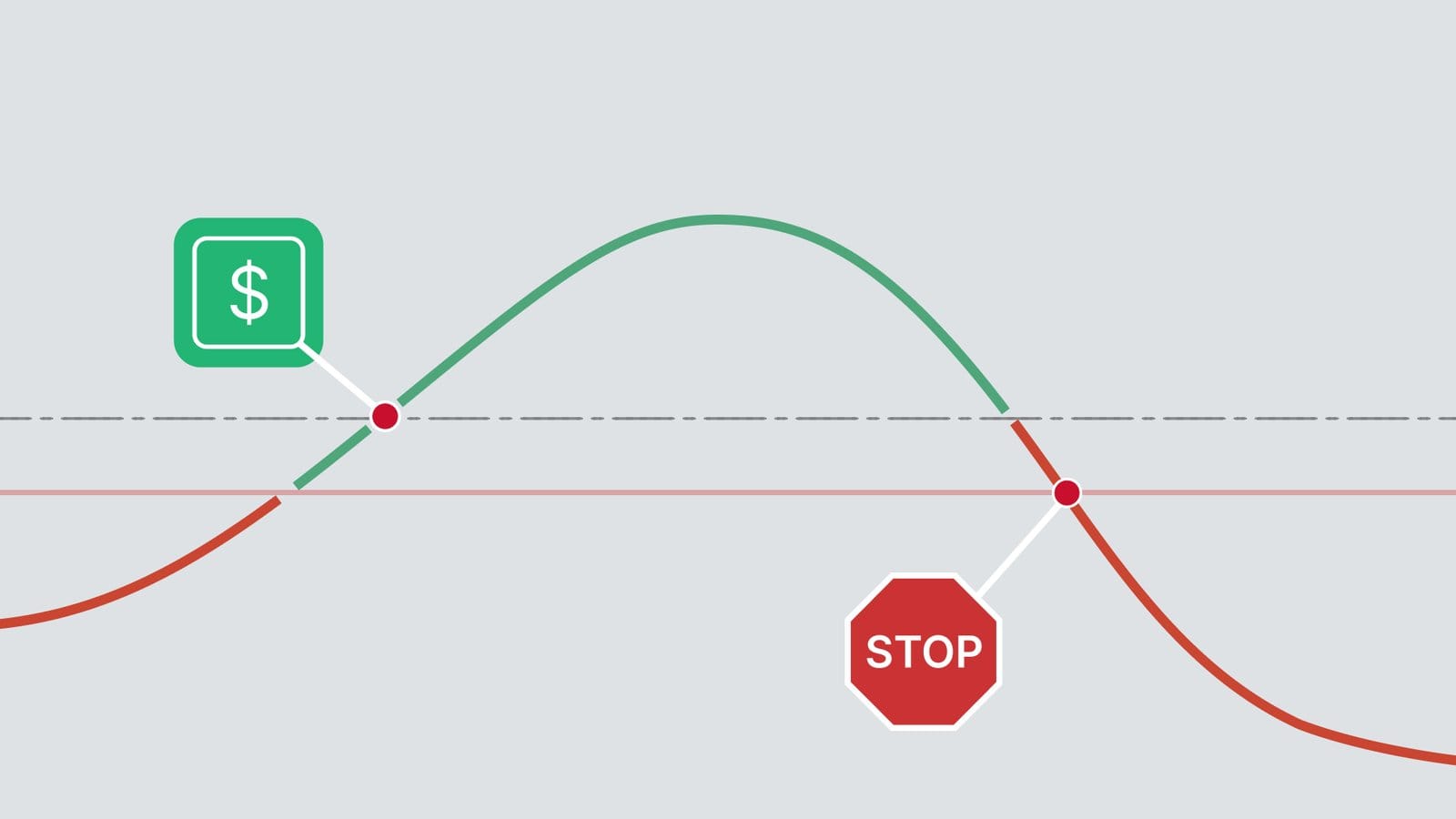

3. Stop-Loss Orders

A stop-loss order automatically exits your trade at a predetermined price, limiting potential losses. Always set logical stop-loss levels based on technical analysis, not arbitrary figures.

4. Diversification

Avoid putting all your eggs in one basket. Diversify your trades across various instruments, sectors, or strategies to minimize risk.

5. Trade Selection and Quality

Focus on high-quality, well-defined setups with clear entry and exit criteria. Avoid overtrading and impulsive entries, which increase exposure to unnecessary risks.

Practical Strategies for Managing Trading Risk

Setting Realistic Goals

Define clear, achievable goals for your trading. Unrealistic goals can lead to risky behavior and emotional trading decisions.

Establishing a Trading Plan

A well-defined trading plan should detail your entry and exit criteria, position sizing rules, stop-loss and take-profit strategies, and risk management parameters.

Regularly Reviewing and Adjusting Strategies

Consistently review your trading journal to evaluate the effectiveness of your risk management strategies, making necessary adjustments to improve outcomes.

Common Mistakes Traders Make in Risk Management

- Overleveraging: Using excessive leverage dramatically increases risk.

- Ignoring Stop-Losses: Hoping losing trades recover often leads to severe losses.

- Poor Position Sizing: Failing to size positions appropriately can magnify risks.

- Emotional Trading: Allowing emotions such as fear and greed to override logic.

Advanced Risk Management Techniques

Trailing Stops

Trailing stops move with the price in your favor, securing profits while still allowing trades to run.

Hedging

Utilize hedging strategies to protect against adverse price movements. Hedging involves taking positions in opposing directions to mitigate risk.

Portfolio Correlation Analysis

Understanding correlations between different assets can help you build a balanced portfolio, reducing overall risk.

Integrating Risk Management Tools

Leverage trading platforms that offer built-in risk management tools such as stop-losses, alerts, and automated risk calculators to enhance your risk management practices.

Recommended Tools and Resources

- TradingView: Advanced charting and analytical tools.

- Risk Management Calculators: Free tools available online for position sizing and risk assessment.

- Educational Platforms: Investopedia, TradingView tutorials, and professional trading courses.

New Concept: Using Risk-of-Ruin Calculators

Most traders focus on how much they can make. Few consider how likely they are to blow up. A risk-of-ruin calculator uses your win rate, risk per trade, and reward-to-risk ratio to estimate the chance of losing most or all of your account.

For example, risking 5% per trade with a 40% win rate gives you over a 60% chance of going bust over 100 trades. But dropping risk to 1% and improving your R:R to 2:1 can bring that ruin risk close to 0%.

You can find free calculators online and use them before scaling up your strategy.

Real-World Example of Effective Risk Management

Imagine a scenario:

- Account Size: $20,000

- Risk per Trade: 1% ($200)

- Trade Setup: Clear breakout above resistance with RVOL confirmation

- Entry: $50, Stop-Loss: $49, Take-Profit: $52 (Risk/Reward = 1:2)

The trade is successful, demonstrating effective risk control and disciplined strategy execution.

Detailed Scenario Analysis

Let’s consider another practical scenario:

- Instrument: ABC stock

- Capital: $15,000

- Risk per Trade: 1.5% ($225)

- Trade Setup: Bounce from a key support level

- Entry Price: $100

- Stop-Loss Price: $98

- Target Price: $105

In this scenario, the risk/reward ratio is approximately 1:2.5. Implementing proper position sizing and clear exit strategies ensures minimized losses and maximized gains.

Continuous Learning and Development

Ongoing education is crucial for risk management. Attend webinars, read industry publications, and engage in trading communities to stay updated on market developments and enhance your risk management knowledge.

Internal Resources

External Resource

Final Thoughts

Mastering risk management is essential for any trader aspiring to long-term success. Implementing disciplined risk management strategies protects your capital, enhances your emotional resilience, and ensures sustainable trading performance. By focusing on effective risk management, you lay the foundation for consistent profitability and long-term growth.

Embrace these strategies today and safeguard your trading future.

FAQs

Q: What’s a safe amount to risk per trade?

A: Most professionals risk 0.5% to 2% per trade. Lower is safer, especially for beginners.

Q: What happens if I ignore risk management and just trade based on signals?

A: Even winning strategies can fail without risk control. One bad streak can destroy your account.

Q: How can I control risk when markets are volatile?

A: Reduce position size, widen stop-loss zones if needed, or stay out when volatility is extreme.

Q: Can I use trailing stops as part of risk management?

A: Absolutely. Trailing stops lock in profits and reduce risk as the trade moves in your favor.