Mastering Breakout Trading: Strategies for Big Market Moves

Breakout trading is one of the most powerful strategies used by professional traders. This blog covers everything you need to know to time your entries, manage risk, and identify high-probability breakout setups.

"Success is nothing more than a few simple disciplines, practiced every day." – Jim Rohn

Breakout trading is an exciting and potentially high-reward approach to capturing strong market moves. When done right, it allows traders to enter the market just as volatility expands and momentum surges. This guide is designed to give you a full breakdown of how to identify breakout setups, execute them effectively, and manage your risk like a pro.

What is a Breakout in Trading?

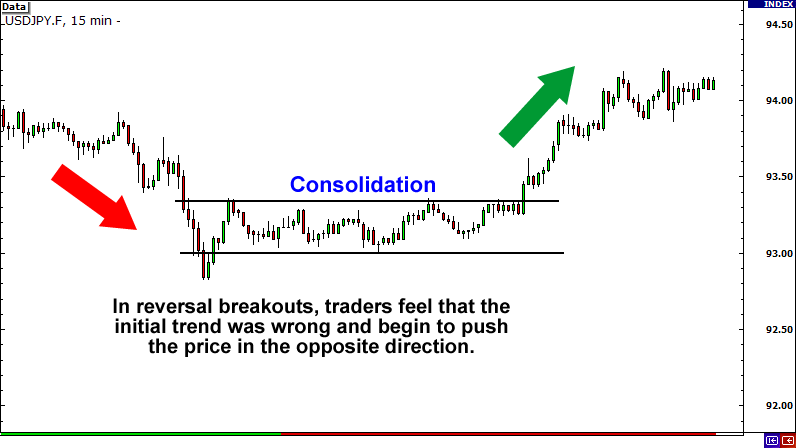

A breakout occurs when the price of an asset moves beyond a defined support or resistance level with increased volume. It signals a potential trend in the direction of the breakout and often leads to rapid price movement.

Breakouts can occur on any timeframe and are particularly common around key psychological levels, chart patterns, or news events. Identifying genuine breakouts (vs. fakeouts) is key.

Why Breakout Trading Works

Breakout trading is based on the idea that price tends to continue in the direction of a breakout once it escapes a range or pattern. This is often driven by trapped traders on the wrong side of the market, institutions piling in, or strong momentum fueled by news or technical factors.

The initial burst of volume and momentum provides a critical edge—especially for intraday or swing traders looking to capitalize quickly.

Key Components of a Breakout

To effectively trade breakouts, you need to:

- Identify Clear Levels – Horizontal support and resistance levels that have been tested multiple times are ideal.

- Watch for Volume Confirmation – A breakout with little volume is usually a fakeout.

- Look for Compression – Tight consolidation before the breakout often leads to a stronger move.

- Understand Market Context – Broader trend, news events, and technical indicators should align.

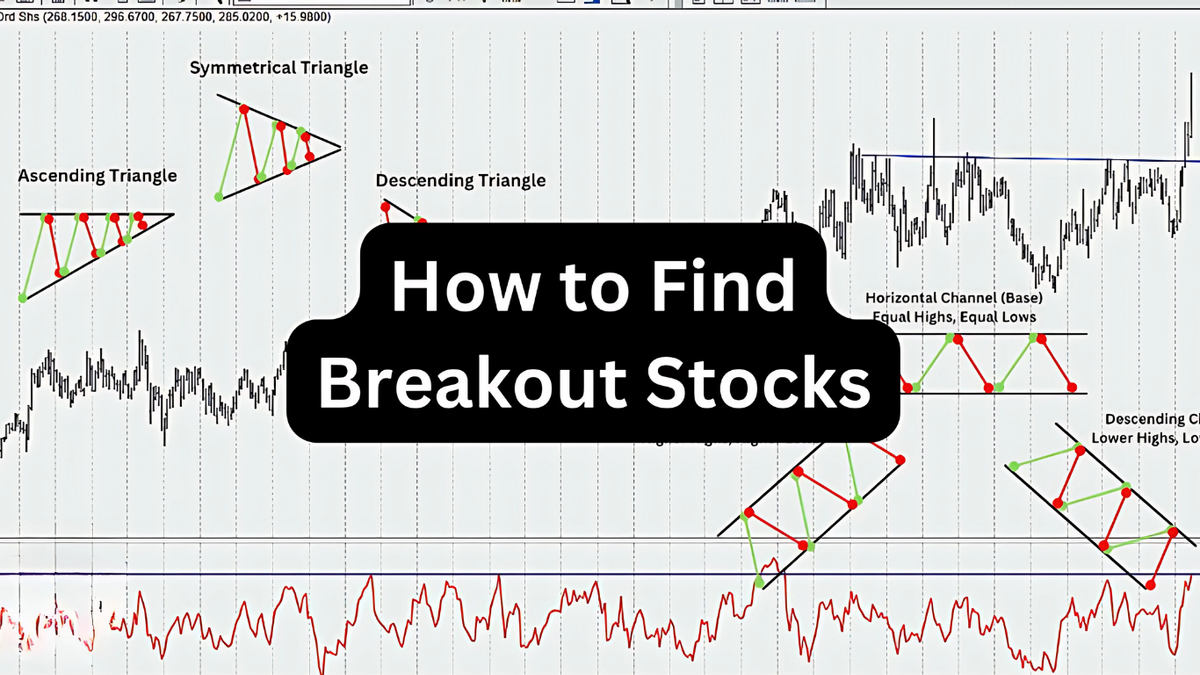

Best Chart Patterns for Breakouts

Some of the most reliable patterns for breakout trading include:

- Triangles (Ascending, Descending, Symmetrical)

- Flags and Pennants

- Rectangles (Consolidation Ranges)

- Cup and Handle

Each of these patterns reflects market indecision and compression before a breakout occurs.

Timing Your Entry

One of the biggest mistakes traders make is entering too early. To time your breakout entry:

- Wait for a close above resistance or below support.

- Confirm with volume – preferably above average.

- Use alerts or scanners to catch real-time breakout moves.

Risk Management Tips

Breakout trading requires strict risk control, especially in choppy markets. Always:

- Set a stop-loss just below the breakout level (for longs) or above it (for shorts).

- Use a fixed % risk per trade (1-2% of account).

- Watch out for false breakouts and re-entry opportunities.

False Breakouts and How to Spot Them

Not all breakouts lead to continuation. To reduce false signals:

- Look for volume divergence (breakout without strong volume).

- Watch for quick rejection wicks and re-entries into the range.

- Use multi-timeframe confirmation.

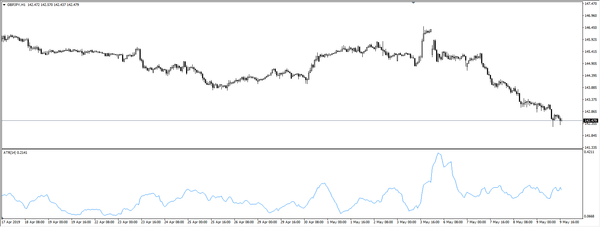

Tools to Help You Trade Breakouts

- TradingView or ThinkorSwim for real-time charting.

- Volume Profile indicators.

- RSI or MACD for momentum confirmation.

- Price Alerts and Scanners to monitor watchlists.

Conclusion

Breakout trading is a powerful strategy that rewards discipline, patience, and timing. By learning to spot real breakout setups, managing your risk tightly, and using the right tools, you can significantly increase your win rate and capitalize on explosive market moves.

Keep practicing, journaling your trades, and refining your system. Breakouts don’t happen every day, but when they do, you want to be ready.

External Links:

- https://www.investopedia.com/terms/b/breakout.asp – Breakout definition

- https://www.investopedia.com/articles/trading/06/breakouts.asp – Breakout strategy article