Master Moving Averages: Enhance Your Trading Strategies

Moving averages are foundational in technical analysis. Discover how to utilize moving averages to improve your trading decisions and consistency.

“In trading, simplicity is the ultimate sophistication.” — Ed Seykota

Moving averages (MAs) are among the most popular and versatile technical indicators in trading. They simplify price data by creating a constantly updated average price, smoothing out price action, and clearly indicating market direction. This detailed guide will teach you how to effectively incorporate moving averages into your trading strategy for enhanced decision-making and consistent profitability.

What Are Moving Averages?

A moving average calculates the average price of a security over a specified number of periods. The two primary types of moving averages are Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

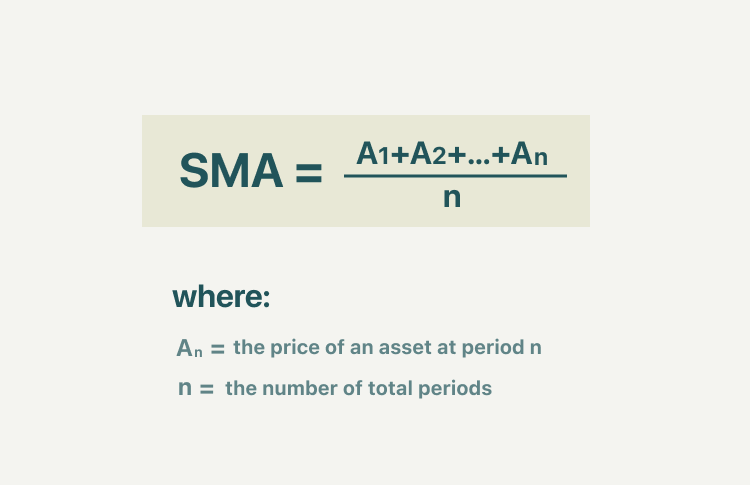

Simple Moving Average (SMA)

An SMA is calculated by averaging the prices over a specific number of periods.

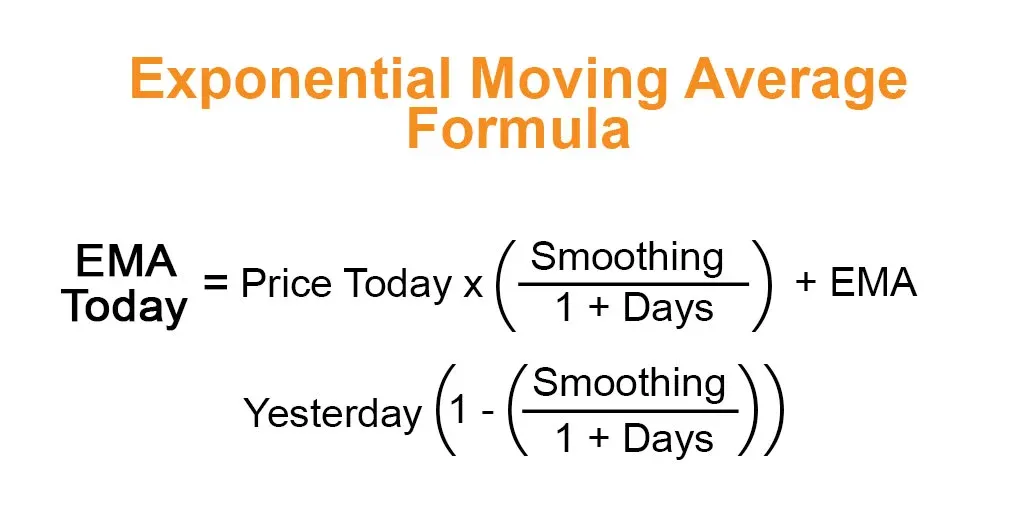

Exponential Moving Average (EMA)

An EMA gives more weight to recent prices, making it more responsive to new information.

Where the Multiplier is calculated as:

Why Traders Use Moving Averages

- Trend Identification: Clearly defines current market trends.

- Support and Resistance Levels: MAs frequently serve as dynamic support and resistance.

- Trade Entry and Exit Signals: Identifies potential entry and exit points based on crossovers and bounces.

Popular Moving Averages and Their Uses

- 9 EMA: Short-term trend indication; useful for day traders.

- 20 EMA: Intermediate-term indicator; frequently used in swing trading.

- 60 SMA/EMA: Widely used for mid-term trend analysis.

- 200 SMA: Long-term market sentiment indicator; respected as major support/resistance.

Moving Average Trading Strategies

Strategy 1: Moving Average Crossovers

Entry Criteria:

- Bullish crossover: Short-term MA crosses above long-term MA, signaling potential bullish momentum.

- Bearish crossover: Short-term MA crosses below long-term MA, indicating bearish sentiment.

Exit Strategy:

- Exit trades when the opposite crossover occurs or at predetermined profit targets.

Strategy 2: Moving Average Pullbacks

Entry Criteria:

- Price retraces to the moving average after establishing a clear trend.

- Enter on confirmation of a reversal candlestick pattern at the moving average.

Exit Strategy:

- Set stop-losses below (for longs) or above (for shorts) the moving average.

- Profit targets at prior highs or significant resistance/support levels.

Combining Moving Averages with Other Indicators

Moving Averages and RSI

- Confirm overbought or oversold conditions for stronger trade entries.

Moving Averages and MACD

- Validate crossovers and momentum shifts.

Common Mistakes Using Moving Averages

- Relying Solely on Moving Averages: Always combine MAs with other technical analysis methods.

- Overlooking Market Context: Ignoring overall market conditions can result in false signals.

- Choosing Inappropriate Periods: Select moving average periods that suit your trading style and timeframe.

Advanced Moving Average Techniques

Multiple Moving Averages

Using several moving averages simultaneously to capture short-term, intermediate-term, and long-term market trends.

Moving Average Envelopes

Placing bands at fixed percentages above and below a moving average to identify extremes and potential reversals.

Practical Example of Moving Average Trading

Consider this scenario:

- Instrument: Stock ABC

- Market Context: Stock in an uptrend, price retraces to 20 EMA

- Trade Entry: Confirm bullish candlestick reversal at 20 EMA

- Stop-Loss: Set below recent swing low

- Profit Target: Prior resistance or recent highs

This method demonstrates clear trade management and disciplined strategy implementation.

Recommended Moving Average Tools

- TradingView: Comprehensive moving average indicators with customization options.

- Thinkorswim: Advanced charting and moving average tools.

- Broker Platforms: Built-in moving average features.

Internal Resources

External Resources

Final Thoughts

Mastering moving averages significantly enhances your trading strategy. They offer clarity in trend direction, act as dynamic support and resistance, and provide effective entry and exit signals. Incorporate moving averages into your daily trading analysis and experience improved consistency and profitability.

Commit to understanding and effectively applying moving averages, and achieve greater confidence and sustained success in your trading career.