Is ATR Useful in Low-Volume Forex Pairs?

Many traders wonder if ATR still works when volume is low. In this article, we break down how ATR performs in quiet forex pairs, how to use it wisely, and when not to rely on it alone. It’s a helpful guide for anyone trading less popular currency pairs.

"Volatility is not something to fear. It's something to understand." – Paul Tudor Jones

In forex trading, some currency pairs don't move as much as others. These are called low-volume or low-volatility pairs. If you're wondering whether the ATR (Average True Range) indicator still works in these slow-moving markets, the answer is yes but with a twist. ATR is not just for fast-moving markets. It helps traders of all levels understand how much a pair typically moves, even when it seems quiet.

Key Takeaways

- ATR helps you measure how much a forex pair moves, even when it's not trending.

- Low-volume pairs still have patterns, and ATR can help spot them.

- Knowing ATR helps you avoid setting stop-losses that are too tight.

- ATR adapts to the current market mood, not just big price spikes.

- You can use ATR to size trades properly in calm or choppy markets.

Why Low-Volume Pairs Can Be Tricky

Low-volume forex pairs, like EUR/CHF or AUD/NZD, don’t move as much as majors like EUR/USD. This means price action can be slower, with tighter ranges and fewer breakouts. Traders often find these pairs more frustrating because trades take longer to develop.

But that doesn’t mean they’re bad. Some traders prefer slower pairs because they tend to be more stable. The key is understanding how to approach them, and that’s where ATR comes in.

How ATR Still Helps in Low-Volume Conditions

Low-volume forex pairs, like exotic currency pairs or some minor crosses, don’t get traded as much as majors like EUR/USD. Because of this, they often move in uneven, unpredictable ways. Still, ATR can be very helpful. Even if volume is low, volatility still exists, and ATR measures volatility, not volume. Let’s look at how it helps.

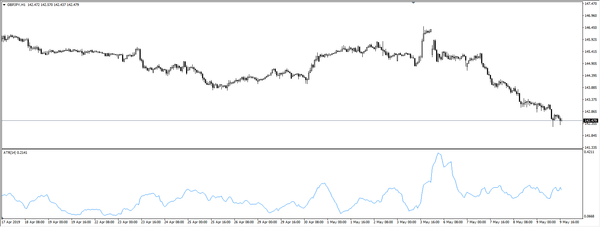

Spotting Sudden Volatility Spikes

In low-volume markets, price can stay quiet for a while and then suddenly move fast. This can catch traders off guard. ATR helps by showing when these sudden moves begin. If ATR rises sharply after a long quiet stretch, it’s a sign that something is changing. This lets you prepare for bigger movements, even if you don’t know which direction.

For example, if you’re watching USD/TRY and the ATR starts climbing after days of calm action, it could mean a news event or big trader has stepped in. This gives you time to adjust your plan before the market makes a big move.

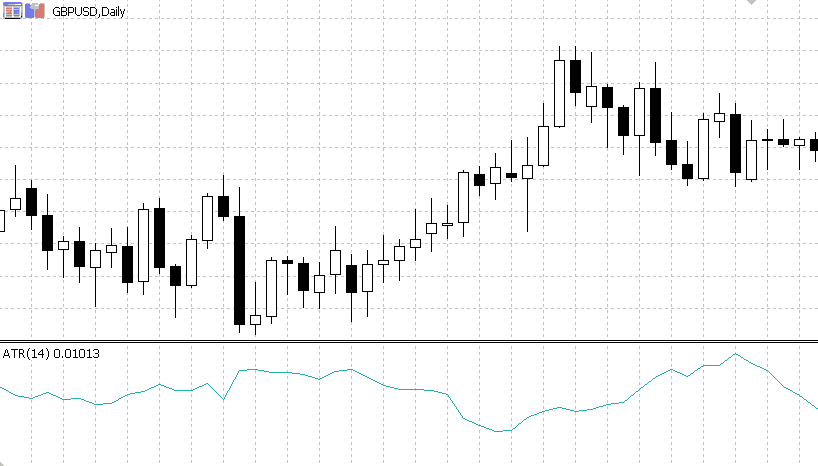

Avoiding Random Noise

Low-volume pairs often have random spikes or fake breakouts. These can hit your stop-loss even if the setup is right. ATR helps you avoid placing your stops too close. If the ATR is showing a typical candle range of 80 pips, setting a 20-pip stop would be risky. With this info, you can place smarter stops based on the actual market behaviour not guesses.

Smoothing Out the Chart for Strategy Use

Low-volume charts can look messy. There are wicks, gaps, and uneven candles. ATR gives you a smoother guide to follow. Even if the chart is hard to read, the ATR line offers a steady signal of how much the market is moving. This is especially useful when using systems like trailing stops, volatility-based position sizing, or range-based entry methods.

Improving Risk Management

Since ATR shows how much a pair is likely to move, it helps you size your trades. In low-volume conditions, risking the same amount you’d use on a highly liquid pair can be dangerous. ATR lets you adjust your position size to match the average range. This way, your risk stays the same, even in choppy or illiquid conditions.

When Not to Use ATR Alone

ATR is a powerful tool, but it doesn’t tell you everything. It only shows you how much the market is moving not why it’s moving, or in which direction. That’s why it’s risky to rely only on ATR when making trading decisions. Here’s when and why you should avoid using ATR by itself.

ATR Doesn’t Show Market Direction

ATR is directionless. That means it doesn’t tell you if the price will go up or down. It only tells you how much the price is moving. This can be confusing if you’re trying to figure out whether to buy or sell.

For example, if ATR is high, it just means the market is volatile not that it's a good time to trade. You might end up entering during a big move, only to get caught on the wrong side of a reversal. That’s why ATR should always be paired with a trend indicator like moving averages or RSI to guide direction.

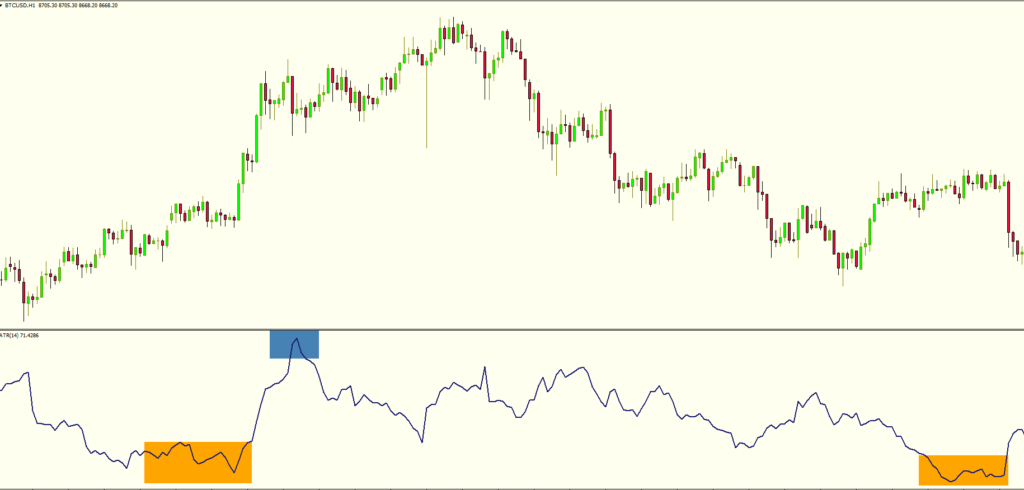

ATR Can Give False Confidence in Ranging Markets

In sideways or choppy markets, ATR might stay low for a long time. That could lead you to believe the market is “safe” or calm. But low ATR doesn’t mean price will follow your plan. Breakouts can still fail, and fakeouts are common when price has no clear trend.

Using ATR alone in these times may lead to trades that look good on paper but fall apart in real-time. It’s better to wait for confirmation from other indicators or from price action before trusting the signal.

News and Events Can Ruin ATR-Based Setups

ATR is based on past price movement. It can’t see future events. If you’re trading during news releases, central bank decisions, or surprise headlines, ATR won’t protect you. The market might suddenly move far beyond the ATR range.

Let’s say ATR says the average candle is 30 pips but then news hits, and price moves 100 pips in seconds. In this case, ATR didn’t help much. That’s why it's important to stay aware of the economic calendar and avoid relying on ATR alone during high-impact events.

ATR Lags Behind Fast Changes

Like many indicators, ATR is calculated using past candles. That means it reacts after something happens. If a huge candle forms, ATR will rise afterward not during the move. So if you wait for ATR to confirm a breakout, it might already be too late to enter at a good price.

For this reason, combining ATR with real-time tools like volume spikes, price action patterns, or live order flow can give you a better edge.

ATR in Low vs. High Volume Pairs

|

Pair |

Average Daily ATR |

Typical Use Case |

Notes |

|

EUR/USD |

60-90 pips |

High liquidity and trends |

ATR helps with breakout trades |

|

EUR/CHF |

20-40 pips |

Slow-moving, tight range |

ATR helps set tighter stops |

|

AUD/NZD |

30-50 pips |

Choppy, lower volume |

ATR aids in range trading |

Pairing ATR with Other Indicators

In low-volume environments, you need more confirmation. ATR + RSI is a strong combo. RSI can tell you if the pair is overbought or oversold, while ATR shows if there’s enough room for the trade to develop. You can also use moving averages or support/resistance to help choose direction.

Conclusion

ATR is still very useful, even in low-volume forex pairs. While it won’t tell you where price is going, it does tell you how far it might move. That alone can help you avoid tight stop-losses, size your trades better, and choose when to trade or when to wait. Add in a second indicator for direction, and you have a complete approach to calmer markets.

FAQs

1. Does ATR work the same on low and high-volume pairs?

Yes, but the average ranges will be smaller in low-volume pairs. The logic remains the same.

2. Can I use ATR for scalping low-volume pairs?

Yes, ATR is helpful for scalpers to decide whether the range is wide enough for small trades.

3. What ATR period works best?

The default 14-period ATR works fine, but some traders use shorter (7) or longer (21) based on their style.

4. Should I avoid low-volume pairs?

Not necessarily. They can be good for range trading and may offer less noise.

5. How do I know if a pair is low-volume?

Look at its ATR value and how often it moves. Pairs with small daily ranges and less price action are usually lower volume.