How to Trade with Confluence: Combining Indicators for High-Probability Setups

Discover how using confluence in trading can lead to more consistent results. Learn which indicators work best together and how to apply them.

"Success is nothing more than a few simple disciplines, practiced every day." — Jim Rohn

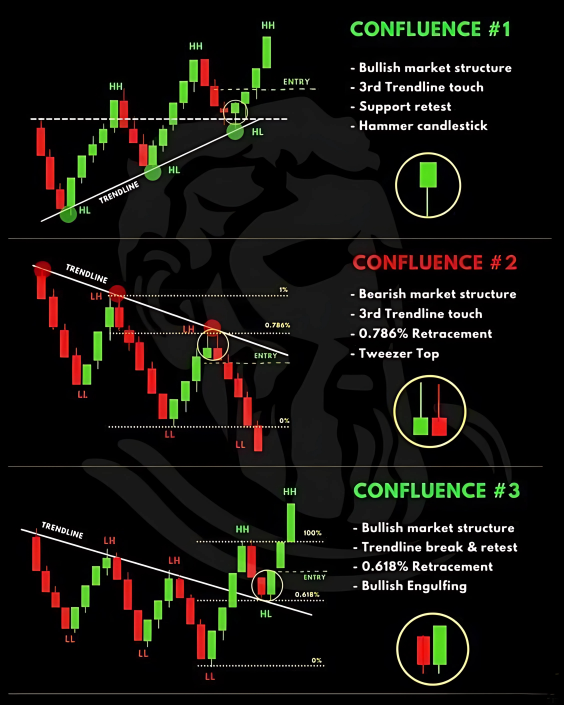

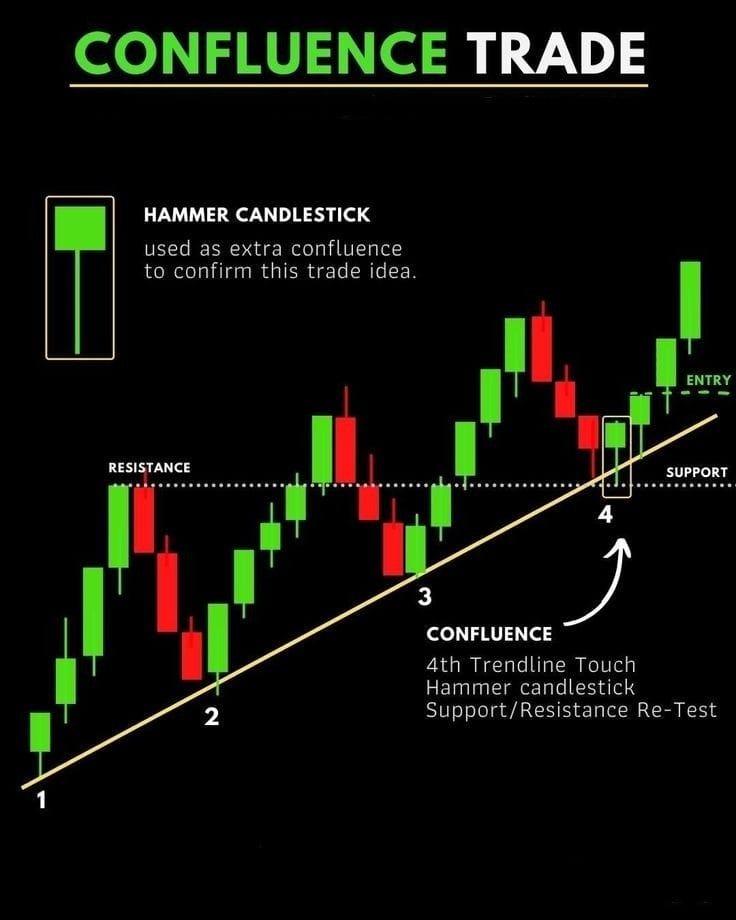

Traders often ask, "How do I know if a trade setup is truly strong?" The answer lies in confluence—the strategic alignment of multiple technical indicators and price action signals. When several elements point in the same direction, your odds of success increase dramatically.

In this guide, we’ll explore what trading confluence really means, why it matters, which indicators to combine, and how to use this approach to identify high-probability trade setups.

What Is Confluence in Trading?

Confluence is when two or more technical factors align to support the same trading decision. Think of it as multiple green lights that increase the likelihood of a smooth drive—except here, you’re looking for profitable trades.

Some common examples of confluence include:

- A trendline bounce aligning with a 200-day moving average

- An RSI oversold signal at a key support level

- A breakout that coincides with high relative volume

Each element strengthens your confidence, giving you a more objective reason to enter or exit a trade.

Why Trading with Confluence Matters

Trading with confluence helps eliminate randomness. Instead of relying on a single indicator or gut feeling, you're validating setups with layered confirmation. Benefits include:

- Increased win rates

- Better risk-to-reward ratios

- Reduced emotional bias

- More disciplined trading

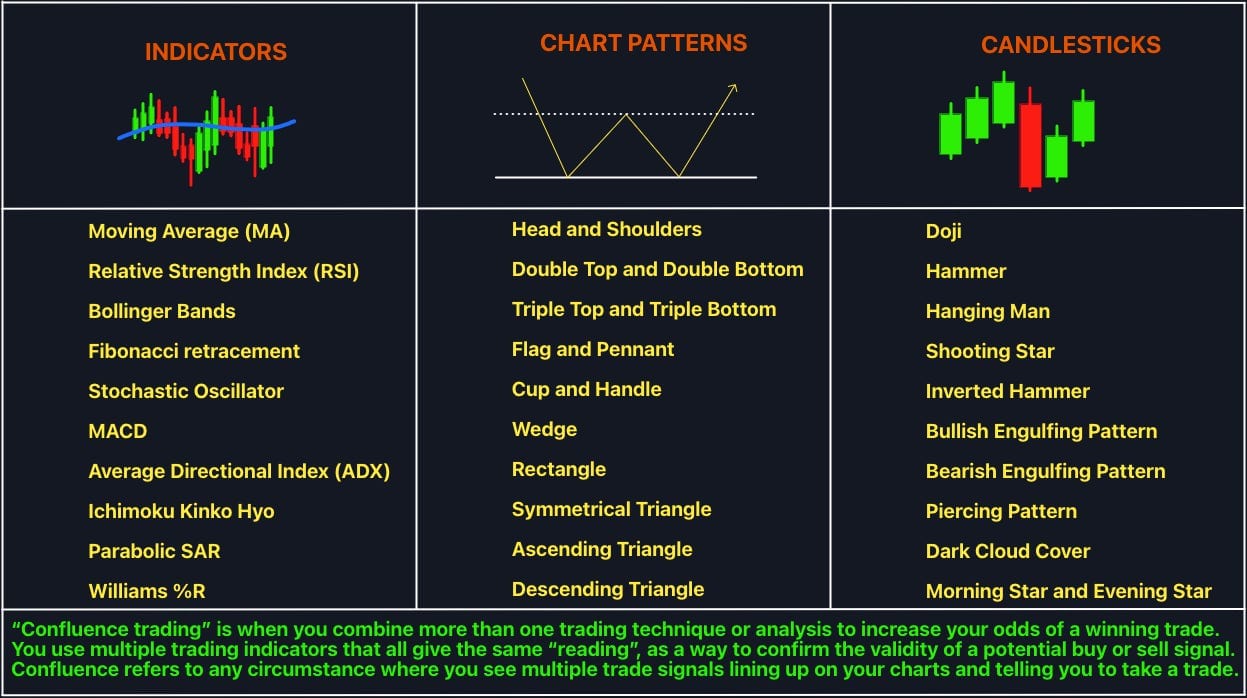

Top Indicators to Combine for Confluence

Here are some of the best indicators and tools to combine when seeking confluence in your trades:

1. Moving Averages (MAs)

- Help identify the direction of the trend

- Combine 20 EMA with the 200 EMA for dynamic support/resistance

2. Relative Strength Index (RSI)

- Measures overbought or oversold conditions

- Combine with support/resistance zones for high-probability reversals

3. MACD (Moving Average Convergence Divergence)

- Tracks momentum and trend reversals

- Combine with crossover confirmation at trendline or MA levels

4. Volume Profile / Relative Volume

- Confirms interest in a price level

- Combine with breakout setups or support zones

5. Trendlines and Price Action

- Simple yet powerful tools to confirm breakout or reversal setups

- Combine with any indicator for entry validation

How to Use Confluence Step-by-Step

Let’s break down how to apply this method:

Step 1: Identify a Strong Market Context

Use higher time frames (4H, Daily) to determine the trend and key levels. Are we in an uptrend, downtrend, or range?

Step 2: Zoom In and Look for Confluence Zones

Look for areas where multiple signals come together. For example:

- A horizontal support line

- RSI shows oversold

- Volume spike

Step 3: Wait for the Trigger

Patience is key. Wait for a price action trigger—like a bullish engulfing candle or breakout—to confirm your thesis.

Step 4: Set Stop Losses and Targets

Use the Stop Losses – How to Use Stop Loss Orders Like a Pro blog as a guide here. Place stops below the confluence zone and calculate a proper risk-reward ratio.

Example of a Confluence Trade

Suppose you're watching a stock that recently bounced from the 200-day moving average. You notice:

- RSI is showing bullish divergence

- MACD just crossed upward

- Volume increased significantly on the last candle

This is a textbook confluence trade. If you also see a price action pattern like a bullish pin bar or engulfing candle, the setup becomes even stronger.

Risk Management with Confluence

While confluence improves probabilities, no trade is guaranteed. Always manage risk. Never increase position size just because you see multiple signals. Stick to your trading plan and predefined stop-loss strategy.

Common Mistakes to Avoid

- Overloading with indicators: Don’t stack 10 indicators. More isn’t always better.

- Forcing confluence: If the signals don’t align, skip the trade.

- Ignoring price action: Indicators support decisions—price action leads them.

Final Thoughts

Trading with confluence is one of the most powerful ways to increase your odds of success. It fosters a rule-based, disciplined mindset and helps you avoid unnecessary risk. Combine it with journaling, backtesting, and continued learning, and you’ll elevate your trading to a professional level.

As always, test strategies in a simulated environment before risking real capital.