How to Set Up a Daily Trading Routine That Works

Learn how to set up a practical and effective daily trading routine that boosts consistency and helps you stay aligned with your trading strategy.

"It's not what we do once in a while that shapes our lives. It's what we do consistently."- Tony Robbins

Day Trading is buying and selling financial products at least once in a single day to take advantage of small price swings. Day trading is not without serious hazards, even though recent performance in key indices suggests that finding profits is simple. This is especially true given how volatile today's markets may be due to abrupt price fluctuations caused by shifting interest rates, rapid economic changes, and geopolitical happenings.

Adopting a reflective approach that prioritizes adaptability, risk management, and understanding the factors influencing recent market movements is essential for day traders to succeed in this environment. With apps that make it simple to analyze indications and place trades, the top day trading platforms assist traders in refining their tactics and cutting expenses. However, for individuals who are just starting in day trading, this article will outline the essential steps to get going.

Also check out What Are Fair Value Gaps and How to Trade Them!

Core Elements of a Successful Daily Trading Routine

You must concentrate on a few essential components that organize your day, hone your decision-making skills, and monitor your long-term development if you want to establish a routine that regularly facilitates profitable trading.

Pre-Market Preparation

It is essential to spend some time preparing thoroughly before the trading day starts. It entails keeping updates of economic data releases, relevant market news, and any overnight events that might affect the markets.

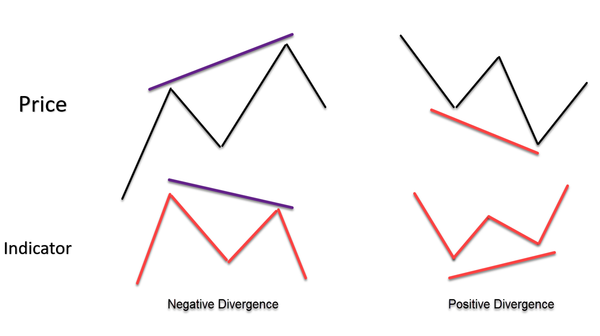

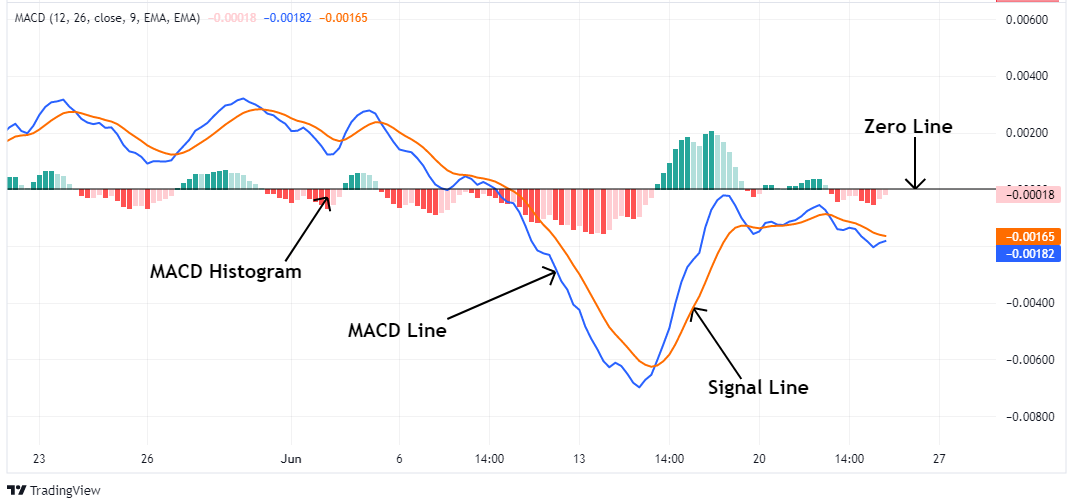

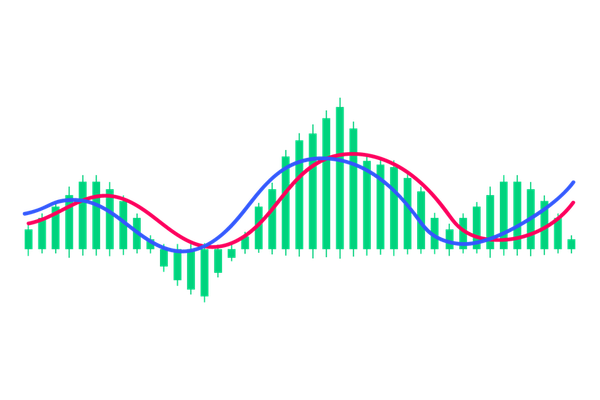

Additionally, traders can find possible trading opportunities and create a clear plan for the day by examining charts, technical indicators, and important price levels. Traders can start the trading session with a proactive strategy to profit from market movements and a well-informed viewpoint by performing a pre-market study.

Record Keeping

Traders can gain insight into their performance and decision-making process by keeping records. Traders can monitor their progress and examine their trading trends over time by keeping thorough records of every trade, including entry and exit points, trade amount, and the reasoning for the trade.

Traders can determine their areas of strength, weakness, and improvement by keeping a trading log and tracking performance indicators.

Time Management

During business hours, time management aids in maintaining attention and maximizing output. Traders can maintain organization and discipline by creating a structured plan and designating particular periods for various trading tasks, including execution, analysis, and research.

Traders can streamline their workflow and prevent attention overload by prioritizing jobs according to their urgency and importance. With effective time management, traders may take advantage of chances and make the most of their trading day.

How to Set Up a Daily Trading Routine

To start day trading, you must gather your funds, find a broker who can manage the volume of your day trades, and practice strategic planning and self-education. Here are five steps to get started:

Research Trading Concepts and Strategies

Retail traders do not often require a specialized undergraduate degree, in contrast to professional traders. You still need to educate yourself, though. Understanding the fundamentals of trading and the particular tactics employed in day trading is essential before you begin trading. Study financial markets, enrol in classes, and read books. Studying technical analysis is the main focus, and it is essential to read up on trading psychology and risk management.

Develop Your Trading Plan

Describe your risk tolerance, investment objectives, and the particular trading techniques you learnt in the previous step. Your plan should outline your overall risk management approach, your entry and exit criteria, and the amount of capital you will risk on each trade. Use a real-time trading simulator to test your strategy before making a real-money investment. This allows you to become acquainted with the trading platform and market behavior without taking any financial risks.

Choose a Trading Platform and Fund Your Account

Reputable brokers with cheap transaction costs, fast order execution, and a dependable trading platform are ideal for traders. Fund your account when you are prepared. Only invest money you can afford to lose in your trading account, and start with a very small initial investment.

Begin Trading With Small Positions

This lessens the possibility that, while you are still learning, you could lose all of your money in a single or a string of poor deals. As you proceed, keep an eye on your trades and compare them to your learning materials to modify your approach. It is necessary to continuously adjust to shifting circumstances when day trading.

Maintain Discipline

Changing your stop-limit and stop-loss settings or other trading criteria when you take on additional risk is not the same as adapting to changing conditions. The ability to regulate one's emotions and maintain discipline is crucial for successful day trading. Do not let your feelings influence your trading decisions. Instead, follow your plan. That is a surefire way to fail.

Setting SMART Trading Goals

Setting SMART (Specific, Measurable, Achievable, Relevant, Time-Bound) trading goals keeps traders focused on their trading objectives.

- Specific traders define what traders aim to reach, whether they are using a particular trading method for orders or hitting a profit target.

- Measurable goals provide specific standards to track development and fairly evaluate results.

- Achievable goals are sensible and attainable, given the traders' skills, resources, and market circumstances.

- Relevant aims guarantee that traders' efforts help to place the right orders, hence matching their general trading goals and ambitions.

- Time-bound objectives provide deadlines or timeframes for reaching goals, therefore fostering responsibility and urgency.

Conclusion

Long-term success in the frenetic world of day trading requires the development of a regular and efficient daily trading strategy. Emphasizing premarket planning, regulated time management, and exact recordkeeping helps traders lay the groundwork for continuous development and lucid decision making. Starting with a solid academic foundation, a proven trading strategy, and a dedication to establishing SMART goals helps keep emotions in check and performance on track. Staying disciplined and flexible is what eventually distinguishes successful traders from the rest, whether you're a novice or honing your strategy.