How to Keep a Trading Journal for Consistent Profits

A trading journal is your most powerful tool for consistent profitability. Learn how to create, maintain, and leverage your journal to enhance your trading performance.

“Discipline is the bridge between goals and accomplishment.” — Jim Rohn

How to Keep a Trading Journal for Consistent Profits

Every successful trader knows that meticulous record-keeping is crucial. Yet, many traders overlook the importance of maintaining a trading journal, missing out on significant opportunities to refine and improve their trading strategies. In this comprehensive guide, you'll learn how a well-maintained trading journal can drastically improve your trading results.

Key Takeaways

- A good trading journal captures both data and emotions.

- Journaling reveals patterns, strengthens discipline, and helps reduce mistakes.

- Analyzing trades is more valuable than just logging them.

- Even failed trades are useful if documented and reviewed correctly.

What Is a Trading Journal?

A trading journal is a detailed record of your trading activities. It includes trades executed, strategies used, emotional responses, market conditions, and outcomes. Its primary purpose is to provide insights and patterns that can enhance your trading decisions and strategies.

Why Every Trader Needs a Journal

Self-Reflection and Improvement

Trading journals enable critical self-reflection. Regularly reviewing your journal highlights both your strengths and weaknesses, allowing you to enhance what works and correct what doesn't.

Consistency and Accountability

Maintaining a journal promotes consistency in your trading strategies. It ensures you stick to your rules and provides accountability for your actions.

Emotional Control

Tracking your emotions during trades helps identify psychological pitfalls like fear and greed, enabling you to manage emotional trading effectively.

Essential Components of a Trading Journal

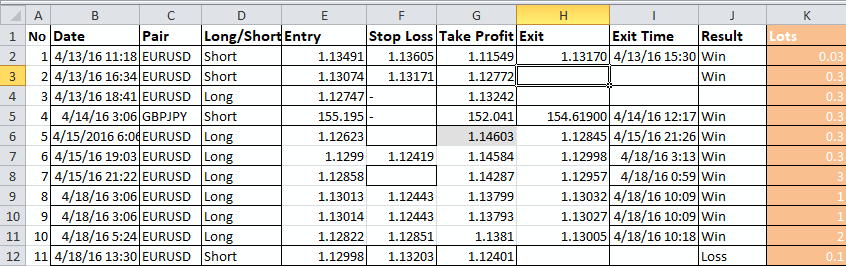

A comprehensive trading journal includes:

- Trade Date and Time: When the trade was placed.

- Instrument/Asset: Stock, currency, crypto, etc.

- Entry and Exit Prices: Precise prices at entry and exit.

- Position Size: Amount of capital risked per trade.

- Reason for Trade: Technical/fundamental reasons for entering.

- Strategy Used: The specific trading strategy or setup.

- Stop Loss and Take Profit: Predefined exit points.

- Risk/Reward Ratio: Assessing potential profitability vs. potential loss.

- Market Conditions: Trending, ranging, volatility level.

- Trade Outcome: Win/loss, profit/loss amount.

- Emotional Notes: Personal feelings and emotional state during trade.

- Screenshots/Charts: Visual documentation of setups.

Sample Trading Journal Entry

| Date | Ticker | Setup | Entry | Stop | Target | Result | Notes |

|---|---|---|---|---|---|---|---|

| 2025-06-24 | EUR/USD | Breakout (RSI) | 1.0840 | 1.0810 | 1.0880 | Loss | RSI was overbought. Entered too early. Wait for candle close next time. |

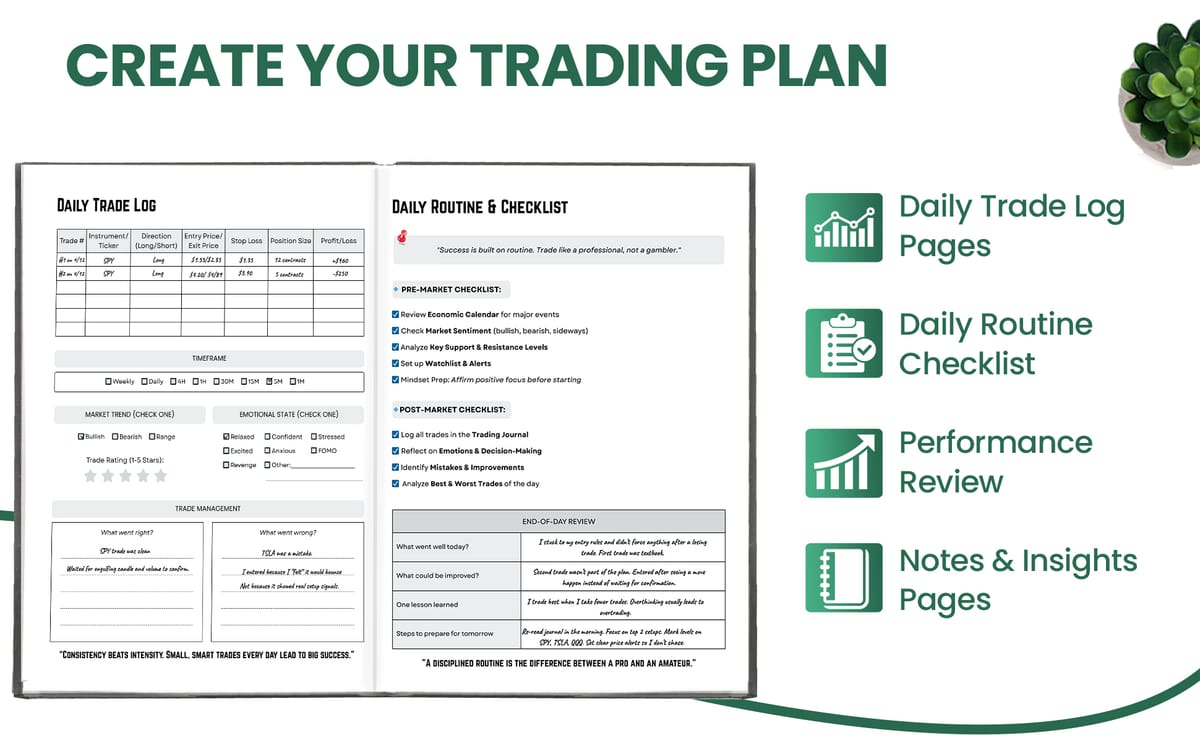

Step-by-Step Guide to Creating Your Trading Journal

Step 1: Choose Your Medium

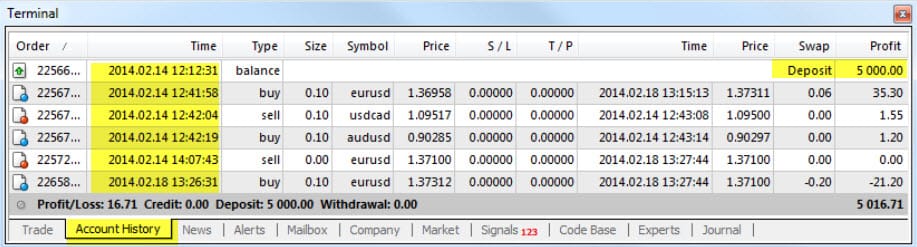

- Digital: Excel, Google Sheets, specialized apps (Edgewonk, Tradervue).

- Paper: Traditional notebook for quick notes.

Step 2: Set Up a Clear Template

Organize columns and sections clearly to ensure easy and consistent data entry.

Step 3: Record Immediately

Record trade details promptly after execution for accuracy.

Step 4: Regular Reviews

Schedule daily, weekly, and monthly reviews. Analyze patterns, identify mistakes, and reinforce successful strategies.

How to Analyze Your Trading Journal

Identify Strengths

Spot patterns of successful trades. What market conditions or setups consistently yield profitable results?

Highlight Weaknesses

Identify recurrent mistakes. Do certain strategies frequently fail? Are emotional factors affecting your trading decisions?

Develop Actionable Insights

Use insights from your analysis to refine strategies, adjust risk management techniques, and set achievable goals.

Common Mistakes in Keeping a Trading Journal

- Incomplete Records: Missing crucial information can lead to ineffective analysis.

- Lack of Honesty: Skewing data or avoiding documentation of losses undermines growth.

- Irregular Updates: Inconsistent journaling defeats its purpose.

Benefits of Maintaining a Trading Journal

- Enhanced decision-making

- Improved discipline and consistency

- Increased confidence

- Reduced emotional trading

- Accelerated learning curve

How to Analyze Your Journal Entries

Writing in your trading journal isn’t just about logging trades as it’s also about learning from them. Here are a few key tips on how to analyze your entries:

- Look for Patterns: Are you consistently losing on breakout trades? Do your winners often follow pullbacks? Spot the setups that work for you.

- Time of Day Check: Does your win rate drop during certain hours? Journaling helps you avoid low-performance periods.

- Emotional Triggers: Track what you felt before each trade. Were you chasing a move or following your plan?

- Review Risk Metrics: Were your losses due to poor stop placement or position sizing? Use this insight to fine-tune your risk management.

Practical Trading Journal Example

Consider this real-life scenario:

- Instrument: Stock XYZ

- Entry: $10.50, Breakout strategy confirmed by high RVOL

- Exit: $11.20, Target resistance reached

- Risk/Reward: 1:2

- Outcome: Profitable

- Emotional Note: Confident due to clear entry signal and adherence to strategy

- Lesson Learned: High RVOL significantly increases breakout reliability

Reviewing such entries clarifies the effectiveness of your trading methods.

Example of a Failed Trade and What It Taught

Let’s say you entered a long position on GBP/USD because price had broken a key level. However, price quickly reversed and hit your stop loss.

- Mistake: You didn’t notice a strong resistance level just above your entry.

- Fix: Use multi-timeframe analysis next time. Always check the higher timeframe for key levels before executing.

- Lesson Learned: One bad trade can be a goldmine of insight — but only if you record and reflect on it.

Recommended Trading Journal Tools

- Edgewonk: Comprehensive journaling software with analytical tools.

- Tradervue: Easy-to-use platform with detailed reporting and visualization.

- Excel/Google Sheets: Customizable and free; great for beginner traders.

Enhancing Your Trading Journal

- Visual Aids: Include charts and screenshots to visualize setups.

- Performance Metrics: Track win rate, average profits/losses, and overall equity curve.

- Strategy-Specific Logs: Separate journals or tabs for different trading strategies.

Integrating Your Trading Journal with Other Tools

- Combine journal insights with chart analysis on platforms like TradingView.

- Automate journaling using integrations (e.g., Zapier linking broker data to journaling tools).

Internal Links

External Resource

Final Thoughts

Consistent journaling is the cornerstone of profitable trading. It provides unmatched clarity, accountability, and continuous improvement. Whether you're a novice or an experienced trader, committing to detailed journaling can significantly enhance your trading performance and accelerate your journey towards sustained profitability.

Begin today, maintain consistency, and watch your trading evolve dramatically.

Ready to Apply This in Real Time?

FAQs

1. Do I really need a trading journal if I only trade occasionally?

Yes. Even if you trade once a week, keeping a journal helps you reflect, spot patterns, and avoid repeating mistakes.

2. What’s the best format for a trading journal, digital or paper?

There’s no “best” format, just what works for you. Spreadsheets are great for data tracking, while handwritten notes can help with emotional clarity. Many traders use both.

3. How often should I review my trading journal?

Weekly reviews work best for most traders. This lets you spot trends in your behavior and performance before they become habits.

4. What’s the most important thing to write down?

Beyond entry and exit prices, your thoughts and feelings during the trade are crucial. Emotional insight often reveals more than numbers alone.

5. Can a trading journal really improve my results?

Yes, dramatically. Journaling adds structure and accountability to your trading. Most consistently profitable traders credit their journals as a key reason for success.