How to Build a Trading Watchlist That Wins: A Step-by-Step Guide

We’ll cover how to build an effective watchlist from scratch using proven methods and modern tools. We'll also explore how to refine it over time to suit your trading style.

"The successful warrior is the average man, with laser-like focus." — Bruce Lee

Creating a powerful trading watchlist is one of the most important steps in developing a repeatable and profitable trading strategy. Your watchlist should act as your radar, showing you only the highest-quality trade opportunities each day. Whether you're a beginner or an experienced trader, the right watchlist will help you avoid distractions, manage risk, and focus on trades with the highest potential.

In this blog, we’ll cover how to build an effective watchlist from scratch using proven methods and modern tools. We'll also explore how to refine it over time to suit your trading style.

Key Takeaways:

- A strong watchlist narrows your focus and reduces emotional trading.

- Free tools like Finviz and TradingView can be powerful when used consistently.

- Paid scanners offer speed, automation, and AI filtering, ideal for day traders.

- Look for patterns that match your strategy and review them daily.

- Success comes from preparation, not prediction.

Why a Watchlist Matters

A curated watchlist gives you direction and removes emotional decision-making. Rather than randomly scanning the market each morning, a well-built watchlist gives you confidence and speed.

When you know what you’re looking for, you can enter trades with precision. This also means better risk management, fewer forced trades, and more time to plan your entries and exits.

Step 1: Define Your Trading Style

Before you build your list, get clear on your trading strategy. Are you a:

- Momentum trader?

- Reversal trader?

- Swing trader?

- Options trader?

Knowing this helps you filter out stocks that don’t fit your criteria. For example, a momentum day trader will be focused on low float, high-volume movers. A swing trader might look for breakouts or consolidations on the daily chart.

Step 2: Use a Stock Screener

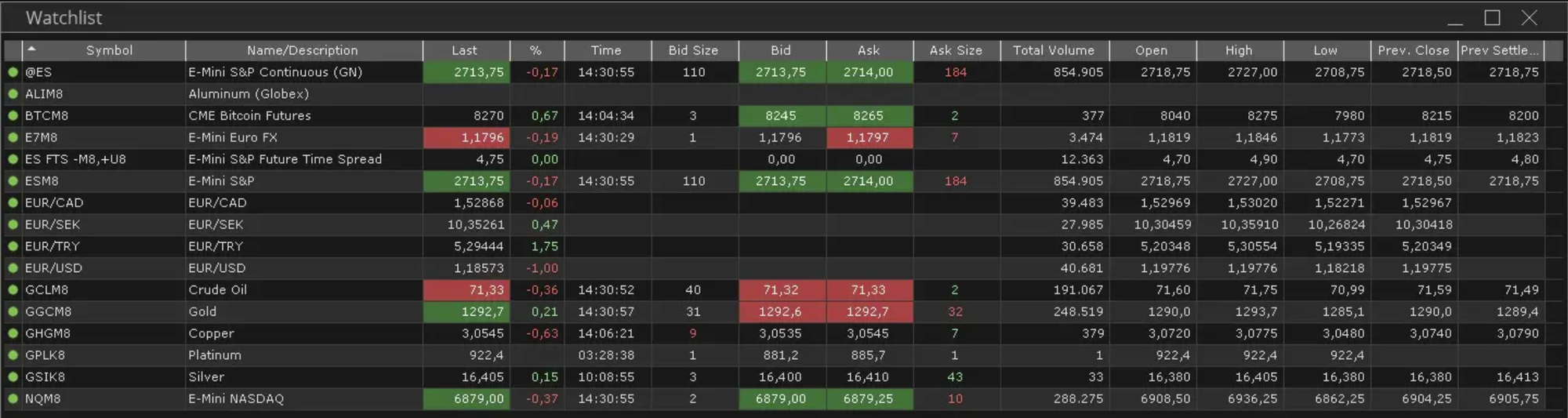

Today’s traders have access to an impressive range of scanning tools that can simplify watchlist building. Here are a few standout options:

- Free Tools

- Finviz – Great for filtering stocks by price, volume, float, or technical setups

- TradingView (Free Tier) – Offers custom filters using Pine Script and easy visual scans

- Yahoo Finance Screeners – Simple and user-friendly for beginners

- Paid Tools

- Trade Ideas – Powerful AI-based scanner with real-time alerts and backtesting

- Benzinga Pro – Ideal for news-based traders needing fast headlines and sentiment

- TrendSpider – Best for automatic chart pattern detection and multi-timeframe analysis

External Resource: Learn more about float and volume from Investopedia

Comparison: Free vs. Paid Scanning Tools

| Feature | Free Tools (e.g., Finviz, Yahoo) | Paid Tools (e.g., Trade Ideas, TrendSpider) |

|---|---|---|

| Real-time data | Limited or delayed | Yes, often instant |

| Custom filters | Basic technical or fundamental filters | Advanced AI or scripting options |

| News integration | Limited | Real-time headlines + sentiment alerts |

| Chart pattern scanning | Manual or basic | Automatic pattern recognition |

| Cost | Free | $30–$120+ monthly |

| Ideal for | Beginners or swing traders | Active intraday traders, advanced setups |

Step 3: Evaluate Catalysts

Catalysts are events that cause price movement. Without one, a stock might not move much even with great technicals.

Types of catalysts:

- Earnings releases

- Analyst upgrades/downgrades

- FDA approvals

- News headlines

- Mergers and acquisitions

A stock with a strong technical setup and a catalyst is more likely to make a clean move.

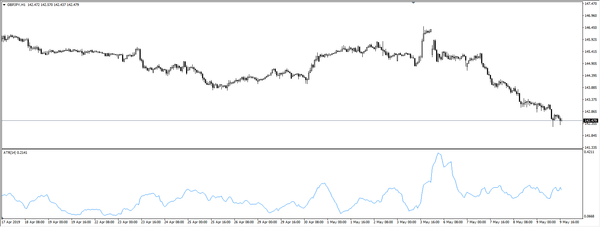

Step 4: Add Technical Patterns

Here are some common patterns traders include in their watchlists, along with what they signal:

- Bull Flag – A strong upward move followed by a tight, downward-sloping consolidation. Indicates continuation.

- Double Bottom – Two clear lows at similar levels, forming a "W" shape. Signals potential reversal upward.

- Breakout from Consolidation – Price tightens in a range, then bursts above resistance with volume.

- False Breakouts (Trap Setups) – Price breaks a level briefly and reverses, trapping early traders.

Use platforms like TradingView to mark support, resistance, and trendlines. Patterns increase the odds of success when paired with volume and catalysts.

Step 5: Limit Your List

Keep your list manageable. For day trading, 5 to 10 tickers is a good target. Too many names leads to FOMO and poor decisions.

You want to be focused, not scattered. Deeply understand the behavior of a few stocks rather than guessing on many.

Step 6: Pre-Market Routine

Do a 15-30 minute prep before market open:

- Check news and earnings calendars

- Review your screeners

- Watch premarket volume and gappers

- Draw levels (support/resistance)

- Finalize your watchlist

Make a habit of writing down your top setups and reasons why they’re on your list.

Step 7: Track and Review

Keep a journal. Document:

- What stocks were on your list

- Which ones you traded

- What worked and didn’t

This helps you improve your screeners, refine patterns, and avoid repeating mistakes.

Success Stories:

- A part-time trader used Finviz + TradingView to build a momentum watchlist and caught a 45% swing on PLTR in 4 days.

- One user leveraged Trade Ideas to scan for gap-fill setups, landing 3 winning trades in a single week.

- A new trader focused only on double-bottom patterns for a month and reached 70% win rate using only 5 tickers.

Bonus Tip: Separate A+ Setups

Not all setups are created equal. Separate your “A+ setups” from the rest. These are your high-probability, high-R/R trades.

Focus 80% of your energy on these.

Conclusion

Building a strong trading watchlist is a skill that pays long-term dividends. It removes noise, helps you prepare, and boosts your win rate. Over time, you’ll develop an edge by knowing what stocks to watch, why they matter, and how to trade them.

FAQs

Q1: How many stocks should be on my daily watchlist?

A: Most traders do best with 5–10 focused tickers. Quality over quantity.

Q2: Should I rebuild my watchlist every day?

A: Yes. Markets change fast. Re-scan daily to stay relevant, especially if you’re a short-term trader.

Q3: Can I use the same watchlist for swing and day trading?

A: You can overlap tickers, but criteria will differ. Day traders need tighter setups and real-time volume.

Q4: Is it worth paying for a scanner?

A: If you're trading daily or full-time, yes, paid tools save time and improve setup detection. For beginners, free tools are enough to get started.

Q5: How do I know if a stock is worth adding to my list?

A: It should have a clean setup, enough volume, clear risk levels, and match your strategy type (momentum, breakout, etc.).