How to Automate Smart Money Concepts in Swing Trading

Want to swing trade like the pros? Learn how to automate smart money concepts using tools like TradingView and simple strategy rules. This beginner-friendly guide breaks down everything you need to know to trade with confidence.

"At first they’ll ask why you’re doing it. Later they’ll ask how you did it." — Unknown

Trading doesn’t have to be overwhelming or overly complex. In fact, many smart traders today use automation to save time and take the emotion out of trading. This article will help you understand how to combine automation with smart money concepts for swing trading. Even if you’re new to trading, don’t worry. This guide will explain things in a simple and clear way.

Key Takeaways

- Swing trading involves holding trades for several days or weeks to capture medium-term market moves.

- Smart money concepts help traders follow the footprints of large institutions by recognizing patterns like liquidity pools, fair value gaps, and order blocks.

- Automation allows traders to save time, reduce emotional decisions, and apply strategies consistently across markets.

- Platforms like TradingView and MetaTrader enable both beginner and intermediate traders to automate trading setups without needing advanced coding skills.

- Starting small, backtesting strategies, and using alerts before full automation are safe and smart ways to build confidence and accuracy.

What Is Swing Trading?

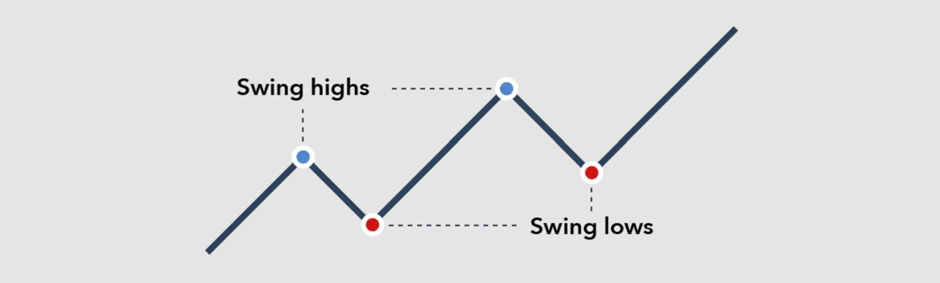

Swing trading is a trading style where you hold trades for several days to a few weeks. It’s different from day trading, where positions are opened and closed on the same day. Swing traders aim to catch bigger price moves using technical setups and market structure. It allows traders more flexibility and time compared to day trading while still offering opportunities to benefit from short-term trends.

What Are Smart Money Concepts?

Smart money concepts are based on how large financial institutions like banks and hedge funds operate in the market. These entities usually have the power to influence price movements, and they tend to follow patterns that leave clues behind on the chart.

For instance, liquidity pools are areas on a chart where many traders place stop-loss orders. These areas often attract price movement because institutional traders seek to trigger those stops for better entries.

Another concept is the fair value gap, which is a price gap left behind after a strong move. Prices often return to fill these gaps before continuing. Order blocks, meanwhile, refer to the final bullish or bearish candle before a sharp move and are commonly used as areas of support or resistance.

Why Automate Your Swing Trades?

Manual trading can be rewarding, but it often comes with stress, fatigue, and emotional mistakes. Automating your swing trading can help reduce these issues while improving consistency and efficiency. Let’s break down the key reasons to automate.

Save Time and Increase Efficiency

One of the biggest advantages of automation is the time it saves. Swing traders often spend hours analyzing charts, setting alerts, and watching for entries. With automation:

- Your system scans for setups 24/7 (or during your preferred sessions).

- You don’t have to sit at the screen waiting for price to hit your zone.

- You can manage multiple pairs or stocks at once without missing a setup.

Remove Emotions from Trading Decisions

Emotions are often a trader’s worst enemy. Fear of missing out (FOMO), revenge trading, and panic exits can ruin a solid plan. Automation helps by enforcing discipline:

- Trades are only taken if specific, pre-set rules are met.

- No room for second-guessing, hesitation, or impulsive decisions.

- Consistency increases, which is key to long-term profitability.

Enforce Risk Management Automatically

Risk management is often talked about but easily ignored in real-time. An automated strategy helps enforce:

- Stop-loss placement: Automatically sets SL levels based on your strategy (e.g., below an order block).

- Take-profit targets: Locks in gains by exiting trades at defined price points.

- Position sizing: Some bots can calculate trade size based on account balance or percentage risk.

Backtest and Optimize Faster

With automation, you can also backtest your strategy. This means running it through past price data to see how it would have performed.

- Find out which setups actually work over time.

- Measure metrics like win rate, average risk–reward ratio, and drawdown.

- Make data-driven adjustments instead of guessing.

Focus on Strategy, Not Execution

Instead of getting caught up in when to click buy or sell, automation lets you focus on improving your logic. You become more like a coach designing plays, while the system handles the game.

- You can focus on higher-level analysis like market conditions or news.

- You’ll spend more time refining strategies that work across different markets.

- Long-term growth becomes more achievable because your process is scalable.

Basic Automation Setup for Smart Money Trades

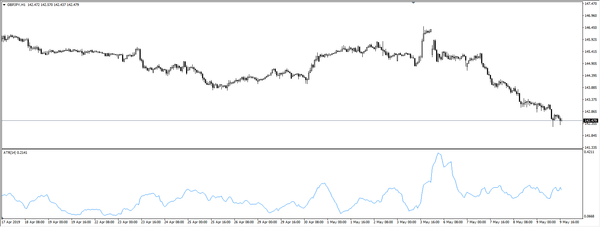

To get started, begin by choosing a trading platform like TradingView. It’s user-friendly and supports Pine Script, a simple scripting language for writing strategies. Next, decide on a trading setup you want to automate such as a trade triggered when price returns to a fair value gap and forms a bullish candle.

You can then build alerts or use bots to act on this setup. TradingView allows for alert-based systems using Pine Script, while platforms like MetaTrader use what are called Expert Advisors (EAs). Other tools like 3Commas and Autoview integrate with exchanges and let you automate trading logic.

Example Strategy: Fair Value Gap Automation

Let’s say you want to automate a trade based on fair value gaps. The idea is to identify a strong bullish move that leaves behind a gap. When price returns to that gap, you wait for confirmation like a bullish candle to enter the trade. You then set your stop-loss below the gap and your take-profit at a recent high. This keeps the strategy simple and rule-based.

Here's a table to help you visualize the process:

|

Step |

Condition |

Action |

|

Step 1 |

Bullish move with a fair value gap |

Mark the zone |

|

Step 2 |

Price returns

to the gap zone |

Wait for

confirmation |

|

Step 3 |

Bullish candle at the gap |

Enter long position |

|

Step 4 |

Set stop-loss

below the gap |

Risk

management |

|

Step 5 |

Set target at recent high |

Exit the trade |

Common Mistakes to Avoid

Many traders make the mistake of using too many indicators, thinking more rules will lead to better results. In reality, this can clutter your strategy and confuse your system. It's also important to always include risk management. Even the best strategies can fail, and without a stop-loss, one bad trade can wipe out your gains. Another mistake is ignoring news events. A perfectly good setup can fail if a major news release causes sudden price changes. Always check an economic calendar before entering a trade.

Conclusion

Automating your swing trades using smart money concepts is a great way to grow as a trader. It removes emotion, saves time, and helps you focus on what works. Start simple, keep learning, and let the market show you what really matters. Over time, you’ll build a system that fits your style and goals. Want to take it further? Explore bots that integrate with TradingView or your broker and join online communities where smart money traders share automation scripts and insights.

Frequently Asked Questions (FAQs)

1. What is swing trading, and how is it different from day trading?

Swing trading involves holding trades for a few days to several weeks, while day trading means opening and closing trades within the same day. Swing traders aim to catch bigger moves with less frequent trading.

2. Do I need to know coding to automate my trades?

Not necessarily. Platforms like TradingView let you create alerts with simple tools, and third-party bots often have user-friendly interfaces that don’t require coding knowledge.

3. What’s a fair value gap in trading?

A fair value gap is a price imbalance or gap left on the chart after a strong move. Price often returns to this gap before continuing in the original direction, and it’s commonly used in smart money strategies.

4. Is automated trading safe for beginners?

Yes, if approached carefully. Start by using alerts instead of auto-execution, always include risk management (like stop-losses), and backtest your strategy on past data before going live.

5. Can I automate smart money concepts like order blocks and liquidity grabs?

Yes, many traders use Pine Script or Expert Advisors to automate rules based on these patterns. While more complex than simple indicators, automation is possible with clear entry and exit conditions.