Best Trading Books to Learn Technical Analysis in 2025

Looking to understand technical analysis without getting lost in complex terms? This guide breaks down the best trading books to learn chart reading, price patterns, and smart trading habits in 2025. Perfect for beginners and intermediate traders.

"There is no elevator to success. You have to take the stairs." — Zig Ziglar

Learning how to trade can be hard, but the right book can make it a lot easier. If you're just starting out or looking to improve your trading skills, reading a good book about technical analysis is one of the best ways to learn. Technical analysis means looking at charts, patterns, and price movements to decide when to buy or sell. In 2025, many books still stand out even if they were written years ago. This list will show you the best books to help you understand charts and become a smarter trader.

Key Takeaways

- Technical analysis helps traders understand price charts and patterns.

- Some books focus on simple tools, while others go deeper into chart reading.

- Many great books are still useful in 2025, even if they’re not brand new.

- These books are good for both beginners and intermediate traders.

- Learning from books can help you build good trading habits and confidence.

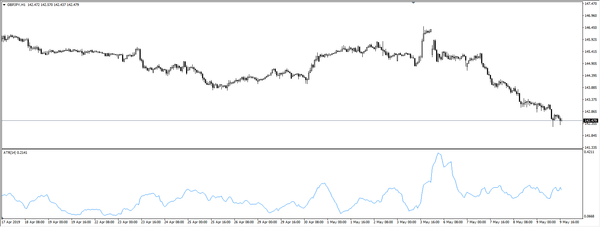

1. Technical Analysis of the Financial Markets by John Murphy

This book is a big favorite among traders. It covers almost everything you need to know about technical analysis, from basic ideas to more advanced tools. It explains chart patterns, trend lines, moving averages, and indicators. The book includes many pictures and charts to help you understand the topics. It’s perfect if you want one book that covers all the basics in one place.

Best for: Beginners who want a full overview of technical tools and how to use them.

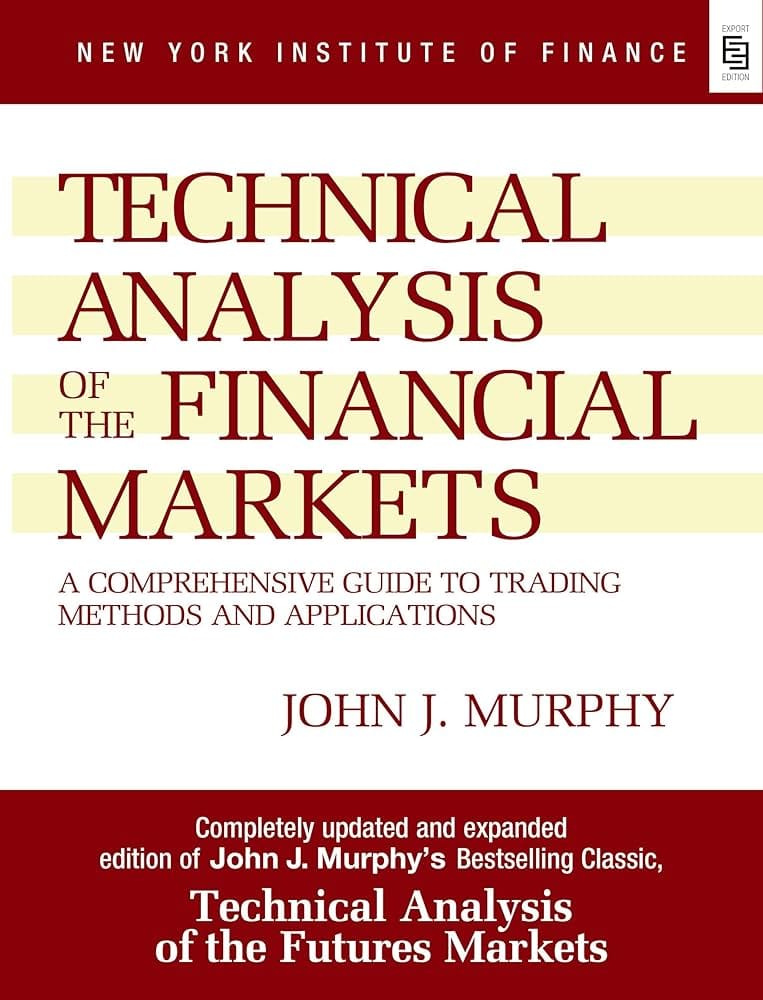

2. Getting Started in Technical Analysis by Jack Schwager

This book is great for beginners. It explains how to read charts, find entry and exit points, and use different indicators. Schwager also talks about how to plan trades and manage risk. It’s easy to read and doesn’t use a lot of confusing words. It also helps you create a simple trading system you can follow.

Best for: New traders who want to go from learning charts to actually placing trades.

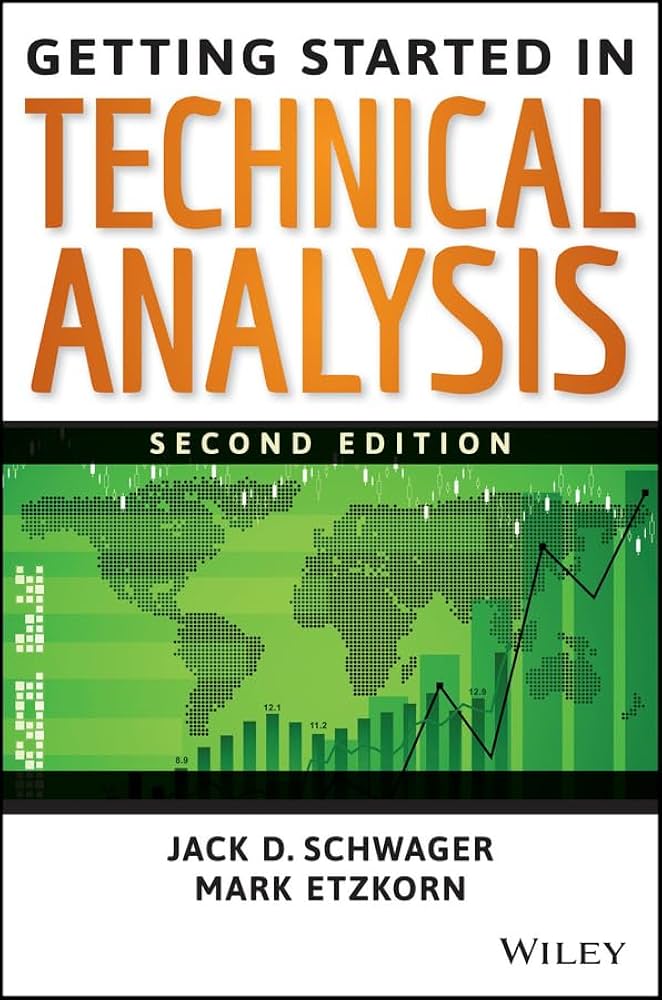

3. Japanese Candlestick Charting Techniques by Steve Nison

This book teaches you how to read candlestick charts, which show price movements in a visual way. Each candle shows if the price went up or down and how strong the move was. Candlestick patterns can help you see when a trend might start or stop. Nison explains over 50 patterns and shows how to use them in real trading.

Best for: Traders who like patterns and want to better time their entries and exits.

4. Encyclopedia of Chart Patterns by Thomas Bulkowski

This book is like a dictionary for chart patterns. It shows you many different shapes that appear on charts, like head-and-shoulders or double tops. Each pattern includes data about how often it works and what usually happens after it forms. It’s more advanced, but very helpful if you already know the basics.

Best for: Intermediate traders who want to know which patterns are most reliable.

5. Technical Analysis Using Multiple Timeframes by Brian Shannon

Shannon explains how to look at charts in more than one timeframe—like a 15-minute chart and a daily chart. This helps you see the bigger picture before making a trade. He shows how to find trends, avoid bad setups, and enter trades at better prices. It’s a simple way to become more confident and accurate.

Best for: Day traders and swing traders who want better timing.

6. A Complete Guide to Volume Price Analysis by Anna Coulling

This book talks about the link between volume and price. Volume means how many people are trading at a certain time. When you combine price movement with volume, it helps you understand if a move is strong or weak. Coulling explains how to read volume bars and shows how big traders may be entering or leaving a trade.

Best for: Traders who want to understand the "why" behind price moves.

7. The New Trading for a Living by Dr. Alexander Elder

This book is about more than just charts. It also covers trading psychology (how to control your emotions) and money management (how much to risk per trade). Elder says good trading needs three things: a system, discipline, and good risk control. He also shows you how to keep a trading journal and learn from your own trades.

Best for: Traders who want to build smart habits and stay consistent.

8. Technical Analysis Explained by Martin Pring

Pring’s book is great for learning both basic and advanced tools. He explains trends, indicators, and how to read chart signals in a step-by-step way. It also covers how to confirm trades and avoid false signals. The book is long but full of helpful advice, and many traders return to it often.

Best for: Beginners and intermediate traders looking for a full guide they can grow with.

Conclusion

These books can help you learn how to trade with confidence. Whether you're just getting started or already trading and want to improve, there’s a book here that fits your needs. Reading one or two of them can make a big difference in how you understand charts, spot patterns, and manage your trades. The key is to keep learning and practicing. Over time, you’ll start to see the market more clearly and make smarter choices.

Frequently Asked Questions (FAQs)

1. Do I need to read all these books?

No, you can start with just one or two that match your skill level. As you improve, you can read more advanced ones.

2. Are these books good for stock trading only?

No, most of them can be used for Forex, crypto, futures, or stock trading. The tools and patterns work across markets.

3. Should I read books or watch videos to learn trading?

Both help. Books go deeper and give full explanations. Videos are great for quick learning. Try both to see what works best for you.

4. What should I learn first in technical analysis?

Start with chart basics, support/resistance, and trend lines. Then move on to candlesticks and indicators.

5. Do I need a trading journal?

Yes, keeping a journal helps you learn from your trades, see mistakes, and improve faster. Many top traders use one every day.